Update on the MiFIR Trading Obligation for Derivatives

The European Securities and Markets Authority (“ESMA”) is seeking stakeholders’ views on the implementation of the trading obligation for derivatives as set out in the Markets in Financial Instruments Regulation (“MiFIR”).

Once implemented, the MiFIR trading obligation will impact on financial counterparties under the European Markets Infrastructure Regulation (“EMIR”) as well as on certain non-financial counterparties.

Background

Weaknesses in over the counter (OTC) derivatives markets exacerbated the financial crisis by contributing to the build-up of systemic risk in the financial system. At the 2009 G20 Summit in Pittsburgh, the G20 committed to substantial reforms of the OTC derivatives markets. These included the introduction of a clearing obligation, requiring all standardised OTC derivatives to be cleared through central counterparties, and a trading obligation requiring all such derivatives to be executed on exchanges or electronic trading platforms, where appropriate.

The EU implemented the clearing obligation in EMIR, which requires certain classes of OTC derivatives contracts to be cleared through central counterparties. For the purpose of implementing the clearing obligation, ESMA distinguishes between four classes of counterparties, namely:

- clearing members of a recognised or authorised central counterparty (Category 1);

- financial counterparties (“FCs”) as defined in EMIR and alternative investment funds (“AIFs”) that are nonfinancial counterparties as defined in EMIR which exceed certain thresholds (“NFC+”) (Category 2);

- FCs and AIFs that are NFCs not falling within Categories 1 or 2 (Category 3); and

- NFCs not falling within another category (Category 4).

To date, the following classes of OTC derivatives are subject to the EMIR clearing obligation: interest rate swaps in G4 currencies, European Index credit default swaps, and interest rate swaps in certain EEA currencies (NOK, PLN, and SEK). See our related briefings:

- EMIR Update - Central Clearing To Begin

- Second Delegated Regulation on EMIR Clearing Obligation

- EMIR Update: The Clearing Obligation and Risk Mitigation Techniques for NonCentrally Cleared OTC Derivatives

The MiFIR Trading Obligation

Under Article 28(1) of MiFIR, certain classes of derivatives transactions must be executed on a trading venue, namely a regulated market, multilateral trading facility (“MTF”), organised trading facility (“OTF”) or certain third country (ie non-EU) trading venues.

MiFIR provides that once a class of derivatives has been declared subject to the EMIR clearing obligation, ESMA has six months to decide whether that class of derivatives should also be required to be traded on a trading venue when traded by relevant counterparties. Whether or not the MiFIR trading obligation applies depends on whether the class of derivatives meets the “venue test” and the “liquidity test”. To meet the venue test the class of derivatives must be admitted to trading or traded on at least one admissible trading venue. In order to satisfy the liquidity test there must be sufficient third party buying and selling interest in that class or a subset of it for it to be considered sufficiently liquid to trade only on the Article 28(1) trading venues.

ESMA must publicly consult on whether a class of derivatives declared subject to the EMIR clearing obligation should also be made subject to the MiFIR trading obligation and must then prepare and submit to the European Commission draft regulatory technical standards (“RTS”) specifying those that should be subject to it and from when.

ESMA may also suggest to the European Commission other derivatives that are not subject to the EMIR clearing obligation (eg, if no CCP is yet authorised in respect thereof ) but which should be subject to trading on an Article 28(1) trading venue.

The EMIR clearing obligation and the MiFIR trading obligation are therefore closely interlinked, although not exactly aligned.

The Discussion Paper

The Discussion Paper seeks stakeholders’ views on ESMA’s first proposals on implementing the MiFIR trading obligation and on its preliminary analysis of some classes of derivatives that could become subject to that trading obligation. It is divided into nine sections providing an overview of the trading obligation in certain other jurisdictions (the United States, Japan, and Switzerland), the EMIR clearing obligation, and the tests for whether the MiFIR trading obligation should apply. It also sets out ESMA’s analysis of the OTC derivatives market and its proposed implementation of, and phasein dates, for the MiFIR trading obligation. Points to note on ESMA’s proposals include the following:

- the “admitted to trading or traded on at least one trading venue” criterion is proposed to focus initially on products admitted to trading on regulated markets and MTFs only. It will not consider products admitted to trading on OTFs, which will only start operating as from 3 January 2018. ESMA intends to reconsider OTFs once they start operating.

- with the exception of Forward Rate Agreements (FRAs) and basis single currency interest rate swaps, instruments belonging to any other OTC derivatives class subject to the clearing obligation may become subject to the MiFIR trading obligation;

- ESMA has not proposed subjecting any OTC derivatives not subject to the EMIR clearing obligation to the MiFIR trading obligation;

- the categories of counterparties for the proposed MiFIR trading obligation are those to which the EMIR clearing obligation currently applies;

- the earliest the MiFIR trading obligation is proposed to apply is the date from which the respective counterparty is subject to the EMIR clearing obligation. However, ESMA is also seeking feedback as to whether some counterparties may need a longer phase-in period for operational reasons; and • the earliest the MiFIR trading obligation can apply is the MiFIR implementation date, 3 January 2018.

Next Steps

Responses to the Discussion Paper must be submitted by 21 November 2016. ESMA aims to publish a consultation paper on the MiFIR trading obligation in the first quarter of 2017 and to submit draft RTS to the European Commission in the summer of 2017, if appropriate. You may access the Discussion Paper here.

In light of the overall delay in the implementation of MiFIR, ESMA intends to delay its draft RTS to closer to the MiFIR implementation date, being 3 January 2018. This is to ensure that the MiFIR trading obligation standards give an up to date picture of the liquidity in derivatives classes based on data that has been collected reasonably close to the implementation date.

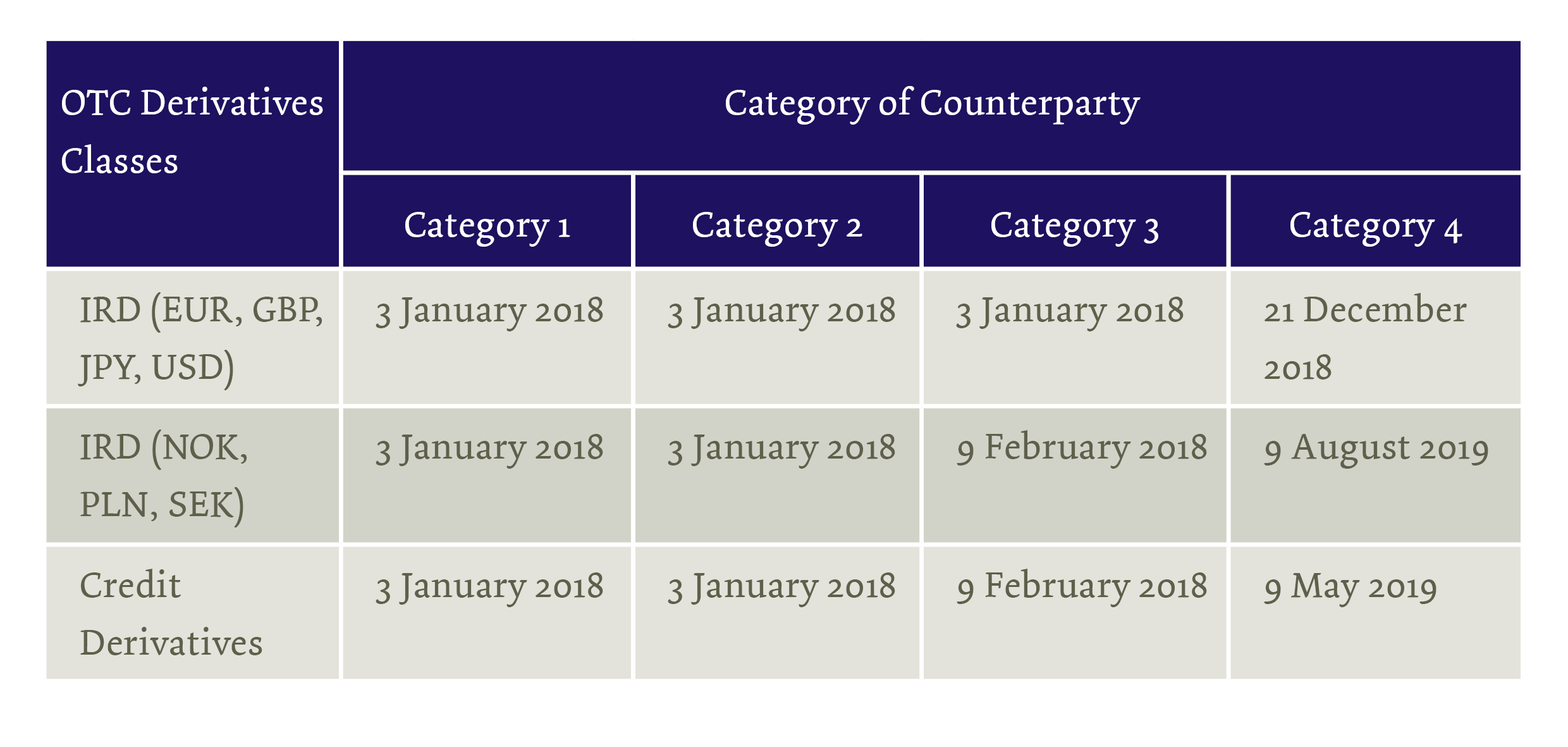

According to ESMA the earliest application date for the MiFIR trading obligation is as set out in the table below:

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below