Knowledge Development Box

The proposed parameters of Ireland’s Knowledge Development Box regime have been revealed in the draft Finance Bill (as initiated) published on 22 October. It will be of particular interest to businesses who have R&D facilities in Ireland or who are considering establishing R&D facilities in Ireland and who operate in sectors involving the commercialisation of patents or software (eg pharma, medical devices, technology, etc). It may also be relevant to businesses that create and commercialise inventions but do not apply for patents in respect of those inventions in certain circumstances.

During his Budget 2016 speech on 13 October, Minister for Finance Michael Noonan announced the high level details of the Knowledge Development Box ie that it will provide for a corporation tax rate of 6.25% (half the standard rate of 12.5%) on profits arising in connection with patents and copyrighted software generated by qualifying R&D carried out by the company and qualifying for the relief. The draft Finance Bill clarifies how it is envisaged that this regime will operate.

Minister Noonan stated that the Irish Knowledge Development Box will be the first OECD compliant patent/knowledge development box regime in the world and is intended to be ‘best in class’. It is clear from the applicable provisions of the draft Finance Bill that the relevant recommendations of the final OECD Action 5 Report (which was published on 5 October 2015 as part of the OECD’s action plan on base erosion and profit sharing (BEPS)) were observed in devising the Knowledge Development Box regime. The question to be considered over the coming weeks, however, is whether or not, as currently proposed, the regime can be considered ‘best in class’.

The further details set out in the draft Finance Bill include the following:

Qualifying Assets

- It will apply to patents (broadly defined eg including supplementary protection certificates) and copyrighted software. In addition, in certain circumstances it will apply to what will effectively be a new category of intellectual property; namely inventions that are certified by the Controller of Patents, Designs and Trade marks as being novel, nonobvious and useful. This is a particularly innovative development that seems intended to maximise the range of intellectual property within the scope of the Knowledge Development Box to the greatest extent possible within the confines of the OECD Action 5 Report.

Qualifying Expenditure

- In addition to own account expenditure on R&D activities within the EU, expenditure on such outsourced R&D will be ‘qualifying expenditure’ where the outsourced work is performed by an unrelated third party. Expenditure on such activities when performed by another member of the company’s corporate group will not be ‘qualifying expenditure’ but may constitute ‘uplift expenditure’, provided that any ‘uplift expenditure’ may not exceed 30% of the qualifying expenditure. As a result, organisations whose R&D activities are shared among multiple members of a corporate group will derive less benefit from the regime than businesses whose R&D and commercialisation activities are carried out primarily by a single entity, or who outsource primarily to unrelated third parties. Uplift expenditure, subject to the above limits, may also include IP acquisition costs and expenditure that is not qualifying expenditure because it is tax-deductible in another territory or relates to activities carried on outside the EU.

Qualifying Profits

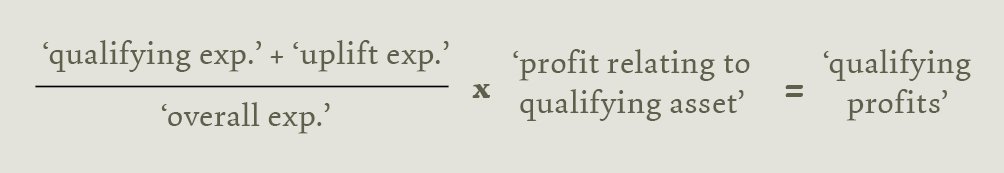

- For the purpose of taking the modified nexus approach to the substantial activity requirement (as recommended for IP regimes in the OECD Action 5 Report), a formula applies as follows:

50 per cent of qualifying profits are then allowed as a deduction from profits so that the amount is taxed at an effective rate of 6.25%. This formula maximises relief to the greatest extent possible within the confines of the OECD Action 5 Report.

Maintenance of Records

- Companies who wish to avail of the reduced rate must maintain appropriate records in order to track the income, ‘qualifying profit’, ‘qualifying expenditure’ and ‘overall expenditure’ relating to any ‘qualifying asset’. This will require maintenance not only of detailed financial records, but also detailed R&D records regarding the creation, improvement and further development of intellectual property within the scope of the regime.

Long-term Certainty?

- The draft Finance Bill currently provides that the Knowledge Development Box regime will be available to companies for accounting periods beginning on or after 1 January 2016 and before 31 December 2020. The rationale for this finite period is unclear. Also, this is contrary to the long-term certainty for taxpayers promised by IDA Ireland in a high level summary of the Irish KDB regime published last week. Since it may limit the appeal of the Knowledge Development Box, particularly to multinational corporations, we would expect that this provision will be the focus of lobbying by stakeholders.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below