Get Ready for ECN+ Antitrust Overhaul in Ireland - Topic 1: A New Risk of Competition Law Fines?

Asked how big fines under new CCPC ECN+ powers will be, CCPC Chair, Isolde Goggin, recently suggested they could be “very substantial indeed.”1 In our first Get Ready for ECN+ briefing, we look at what that might mean.

Background

The stated purpose of ECN+ Directive 2019/1 is “to empower the competition authorities of the Member States to be more effective enforcers and to ensure the proper functioning of the internal market.”

In particular, the ECN+ Directive requires that competition authorities can “… either impose by decision in their own enforcement proceedings, or request in non-criminal judicial proceedings, the imposition of effective, proportionate and dissuasive fines” (Article 13(1)).

Under Ireland’s existing enforcement regime, breaches of competition law must generally be prosecuted on indictment, by the DPP, before a jury in the Central Criminal Court. Guilt must be proven to the criminal standard, i.e. beyond reasonable doubt.

Defendants face fines up to the greater of €5m or 10% of turnover. In reality, however, Irish court fines have been far lower. In 25 years of competition law enforcement, Irish criminal courts fined companies, in total, €323,000. The highest single fine to date is €80,000, imposed on Citroen car dealer in 2008 for participation in a price fixing cartel.

Irish Competition Law Fines 1996 - 2021

- In May 2017, Aston Carpets & Flooring was fined €10,000 following conviction for cover pricing in floor contract procurements.

- Over a period of 11 years, concluding in 2012, 10 companies were fined a total of €86,000 following conviction for participation in a price-fixing cartel in respect of the retail prices of home heating oil.

- From 2008 to 2009, six companies were fined a total of €227,000 for participation in a price fixing cartel in the sale of Citroën cars.

How to implement Article 13(1) of the ECN+ Directive into Irish law has caused controversy. Broadly, two possibilities were debated: (i) to give the CCPC power to fine business directly, just like the European Commission when it enforces EU competition law, or (ii) to continue to reserve to Irish Courts power to impose penal sanctions, but permitting such sanctions on proof by the CCPC of its case to a civil standard.

While draft legislation is not yet published, it already appears clear that the CCPC will have de facto power to fine business directly for competition law violations, albeit that the CCPC’s proposed fine may require Court confirmation.

In short, Ireland’s primary competition law enforcement agency, the CCPC, will for the first time have power to investigate suspected violations, decide on liability and impose (following court confirmation) substantial, multi-million fines.

The CCPC has been calling for civil fines for nearly 20 years and this is likely the most significant competition law reform since adoption of Ireland’s first law, the Competition Act 1991.

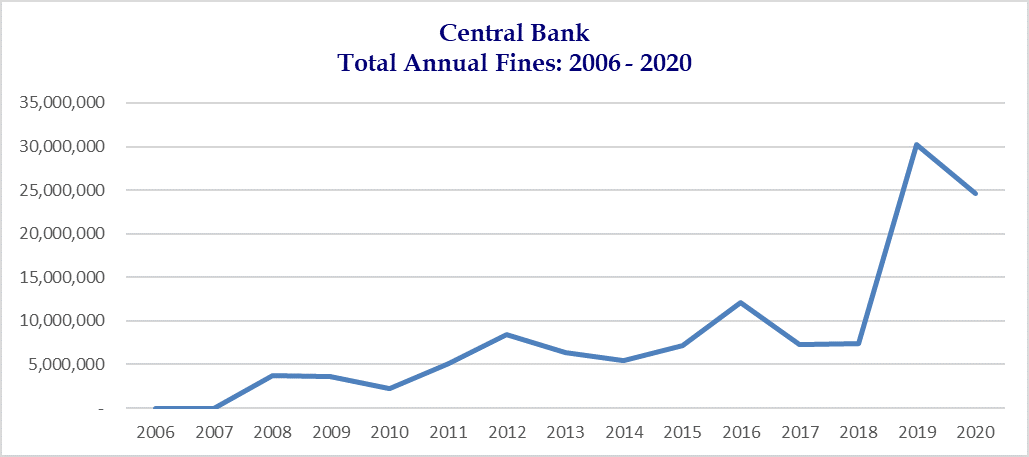

Fines by Other Irish Regulators

The Central Bank of Ireland is the only Irish regulator with an established track record of imposing significant fines on Irish firms. Since 2006, when the Central Bank and Financial Services Authority of Ireland Act 2004 first created a CBI fining process, CBI enforcement actions have resulted in 141 fines on regulated entities totalling €165,730,119.2

Other regulators such as the Broadcasting Authority of Ireland, the Data Protection Commissioner, and (albeit in limited areas) the Commission for Regulation of Utilities have fining powers, but have rarely used them to date.

Under the Broadcasting Act 2009, the BAI may fine broadcasters up to €250,000, and the BAI has done so once when State broadcaster, RTÉ, was fined €200,000 for broadcasting a 2012 programme that was found to contain serious, damaging and untrue allegations.

Similarly, the DPC has imposed its first cross-border effect fine under GDPR rules, when it fined Twitter €450,000 late last year. The DPC had considered a lower fine, but increased it following mandatory consultation with data protection agencies in other Member States. The CCPC doubtless took note of strong objections by authorities in a number of other Member States to the DPC fine as, according to German and Austria regulators, “unreasonably low.”

The CRU has yet to use its powers to impose a fine on a regulated firm.

CBI fining practice is thus the only real comparator at national level that might provide some indication of how CCPC fines may develop in the coming years.

From the below graph, CBI fines started low. The first fine on a regulated entity took place in 2007 and was €5,000. But CBI fines increased relatively quickly. Of eight fines levied by the CBI in 2008, seven were under €100,000, although one fine was €3,450,000. In 2009, of eight fines imposed, five were under €100,000, while the three others were €250,000, €600,000, and €2,750,000.

This compares with 2020, when four CBI fines were imposed, only one of which was below €100,000, while the other three were (i) €1,660,000; (ii) €4,600,000, and (iii) €18,314,000. The highest fine ever imposed by the CBI is €37,774,520.

While the CCPC will operate under a different framework, it is possible that the CCPC will draw lessons from the CBI’s experience of administrative fines.

Fines by Competition Authorities in Comparable Member States

In a majority of EU Member States, competition law enforcement agencies already have power to impose administrative fines.3

The French Competition Authority (the “FCA”) and the German Federal Competition Office (the “FCO”) are the most active enforcers across Europe and both agencies have high fining records. In 2019, the FCA imposed a total of €632m in fines while the FCO imposed a total of €848m.4

Closer comparators for Ireland may be Austria, Finland and Portugal, each of which has GDP broadly equivalent to Ireland’s.

Austria

In Austria, total fines for competition law violations amounted to €1,800,000 in 2019.5 Examples of recent fines include:

- In July 2020, a fine of €294,000 on a relatively small pool equipment supplier for resale price maintenance.6

- In 2019, a fine of €210,000 on a relatively small snack and coffee supplier for resale price maintenance.7

- In 2015, a fine of €30,000,000 on a major grocery retail outlet for resale price maintenance.8

Finland

In Finland, total fines for competition law violations amounted to €9,165,000 in 2019.9 Examples of recent fines include:

- In March 2021, fines totalling €3,200,000 were imposed on two building insulation makers for participation in a price cartel.10

- In February 2021, fines totalling approximately €22,000,000 on a trade association and six companies for price fixing in the real estate management sector.11

- In August and October 2020, fines totalling €160,000 for bid rigging.12

Portugal

In Portugal, total fines for competition law violations amounted to €340,000,000 in 2019.13 Examples of recent fines include:

- In December 2020, fines totalling €304,000,000 (the highest ever) were imposed on six large food retail chains, two beverage suppliers, a board member and a director for price fixing via a hub-and-spoke cartel.14

- In the same month, a fine of €84,000,000 was imposed on MEO, a telecommunications operator, for market sharing and price fixing.15

- In October 2020, a fine of €3,600,000 was imposed on an association of Portuguese advertising agencies for restraining its associates from freely participating in procurement tenders for advertising services.16

Other Sources of Guidance on Fines

Little judicial guidance on sentencing and fining in competition law cases exists in Irish law.

In DPP v Duffy [2009] IHEC 208, a price fixing case, McKechnie J described competition law violations as “particularly pernicious” and distinguished the Irish approach on sentencing from EU and UK counterparts stating that the Irish legislation “… permits the Court to take into account the turnover of the undertaking’s entire business irrespective of the causative connection between the offending behaviour and that turnover”.

More specifically, McKechnie J (citing UK case R v Whittle [2008] EWCA) also took account of the following factors: “… the gravity of the offences: the circumstances in which the offences were carried out; the nature of the offences and the continuing duration of their commission; the part played by the defendant in them, the corporate circumstances of the company; and any aggravating and mitigating factor; and, finally, where appropriate the principles of proportionality and totality.” McKechnie J fined the company €50,000.

The ECN+ Directive provides that the CCPC must “have regard both to the gravity and to the duration of the infringement when determining the amount of the fine.” No doubt Irish implementing legislation will include similar provisions.

At the Joint Committee on Enterprise, Trade and Employment, Ms Goggin indicated that the “normal practice” is that there are fining guidelines which outline the aggravating and mitigating factors. The CCPC may well, therefore issue fining guidelines, which would be welcome.

Other administrative fining regimes in Ireland have adopted this approach. In 2019, the CBI published a guide to sanctions imposed under its Administrative Sanctions Procedure which sets out the factors taken into account, including, cooperation, self-reporting and remediation.17

Also contributed by Niall Fitzgerald and Louise O’Callaghan.

Download PDF- Transcript of the Joint Committee on Enterprise, Trade and Employment debate, Tuesday, 23 February 2021. Question from Louise O’Reilly TD, Sinn Féin, Transcript of the Joint Committee on Enterprise, Trade and Employment debate, Tuesday, 23 February 2021. Available at here.

- Note that under the Central Bank’s Administrative Sanctions Procedure, the CBI may either enter into a Settlement Agreement, under which a regulated entity may benefit from a reduction in the fine imposed, or else refer the matter to an Inquiry. Where an Inquiry occurs, the Inquiry Members, comprising internal officers and employees of the Central Bank as well as external individuals, carry out a hearing. An Inquiry may also include external members who are neither internal officers nor employees of the Central Bank. On conclusion, the Inquiry Members may impose a sanction. A decision of an Inquiry is appealable to the Irish Financial Services Appeals Tribunal, and subsequently to the High Court. Of three matters referred to Inquiries to date, two concluded with the Central Bank entering into settlement agreements with the respective parties. The decision in the third Inquiry is currently pending.

- In three Member States, fines are imposed by civil courts and in five Member States, including Ireland, fines are criminal or quasi-criminal in nature and are imposed mainly by criminal courts. Commission Staff Working Document, Impact Assessment accompanying the Proposal for a Directive of the European Parliament and of the Council to empower the competition authorities of the Member States to be more effective enforcers and to ensure the proper functioning of the internal market, page 21. Available here.

- French Competition Authority, Summary of Annual Report 2019. Available here. German Federal Competition Office, Annual Report 2019. Available here. In March 2020, the FCA imposed a record €1.2bn fine on Apple and two wholesalers, Tech Data and Ingram, in relation to certain distribution arrangements which the FCA found removed competition from the wholesale market for certain Apple products. In respect of the fine imposed on Apple, the value of products’ sales concerned was around 1% of turnover, and the FCA, taking into account Apple’s significant overall size, economic strength and resources, increased the fine by 90%.

- Austrian Federal Competition Authority, Annual Report 2019. Available here. The Austrian Federal Competition Authority (the “AFCA”), does not have the power to impose fines itself, but can request the Cartel Court to impose a fine. Under Austrian law, an infringement may lead to an administrative fine of up to 10% of the group’s turnover in the year prior to the verdict.

- Austrian Federal Competition Authority, Zodiac Pool Care Europe fined, 29 July 2020. Available here.

- Austrian Federal Competition Authority, Anker Snack & Coffee, 13 May 2019. Available in German only here.

- Austrian Federal Competition Authority, Spar, 12 August 2016. Available in German only here.

- In 2019, FCCA applications to the Market Court resulted in fines of €265,000. In addition, the Supreme Administrative Court of Finland, on appeal, imposed a fine of €8.9m on seven bus companies, a group of bus companies and the Finnish Bus and Coach Association (Decision of the Supreme Administrative Court of Finland 98/2019). In Finland, the Finnish Competition and Consumer Authority (the “FCCA”) carries out the investigation, and where necessary, makes proposals to the Market Court for the imposition of fines. Under Finnish law, a fine cannot exceed 10% of the turnover of the company concerned during the year in which the company was last involved in the infringement and in 2011 the FCCA published guidelines which set out the factors taken into account by the FCCA, including the nature and extent, the degree of gravity and the duration of the infringement

- Decision of the Market Court 70/2021. The Market Court’s decision followed a proposal from the FCCA in December 2018.[8] The fine imposed by the Market Court was €800,000 less than that proposed by the FCCA.

- Finnish Competition and Consumer Authority, FCCA proposes that EUR 22 million in penalty payments be imposed for a price cartel on companies in real estate management and the Finnish Real Estate Management Federation, 15 February 2021. Available here.

- Decisions of the Market Court 375/20, 378/20, 449/20 and 450/20. The fines were imposed on the Helsinki and Uusimaa Hospital District in relation to four proposals submitted by the FCCA in respect of direct procurements which were in breach of the Finnish Act on Public Procurement and Concession Contracts.

- In Portugal, the Portuguese Competition Authority (the “AdC”) has the power to impose fines itself up to 10% of a company’s turnover. In determining the level of the fine, the AdC can consider, the seriousness of the infringement, the nature and size of the market affected, and the advantages gained by the party concerned.

- Portuguese Competition Authority, The AdC imposed fines on six large retail food chains and two suppliers for price fixing, harmful to consumers, 21 December 2020. Available here.

- Portuguese Competition Authority, AdC imposes fine of 84 million euros to MEO for cartel with NOWO, 3 December 2020. Available here.

- Portuguese Competition Authority, AdC imposes fine of €3.6 M to APAP for restraining competition in advertising services, 22 October 2020. Available here.

- Central Bank, ASP Sanctions Guidance, November 2019, available here.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below