Crowdfunding: To Regulate or Not?

The Department of Finance has published a consultation paper on the costs and benefits of regulating crowdfunding in Ireland. This consultation is taking place in the context of the Department’s work on how to facilitate the development of crowdfunding in Ireland while ensuring adequate protection for small investors and consumers.

What is crowdfunding?

Crowdfunding is the raising of finance from a large number of individuals or institutional investors to fund businesses or projects through online web-based platforms. There are a number of different types of crowdfunding, including donation and reward based, peer-to-peer and investment based. Types of crowdfunding fall in to two general categories, namely non-financial and financial.

In 2015, approximately €4.1 billion was raised through equity investment or loan-based crowdfunding platforms by businesses across the EU. There are now more than 500 platforms providing a range of crowdfunding services in the EU.

Why regulate crowdfunding?

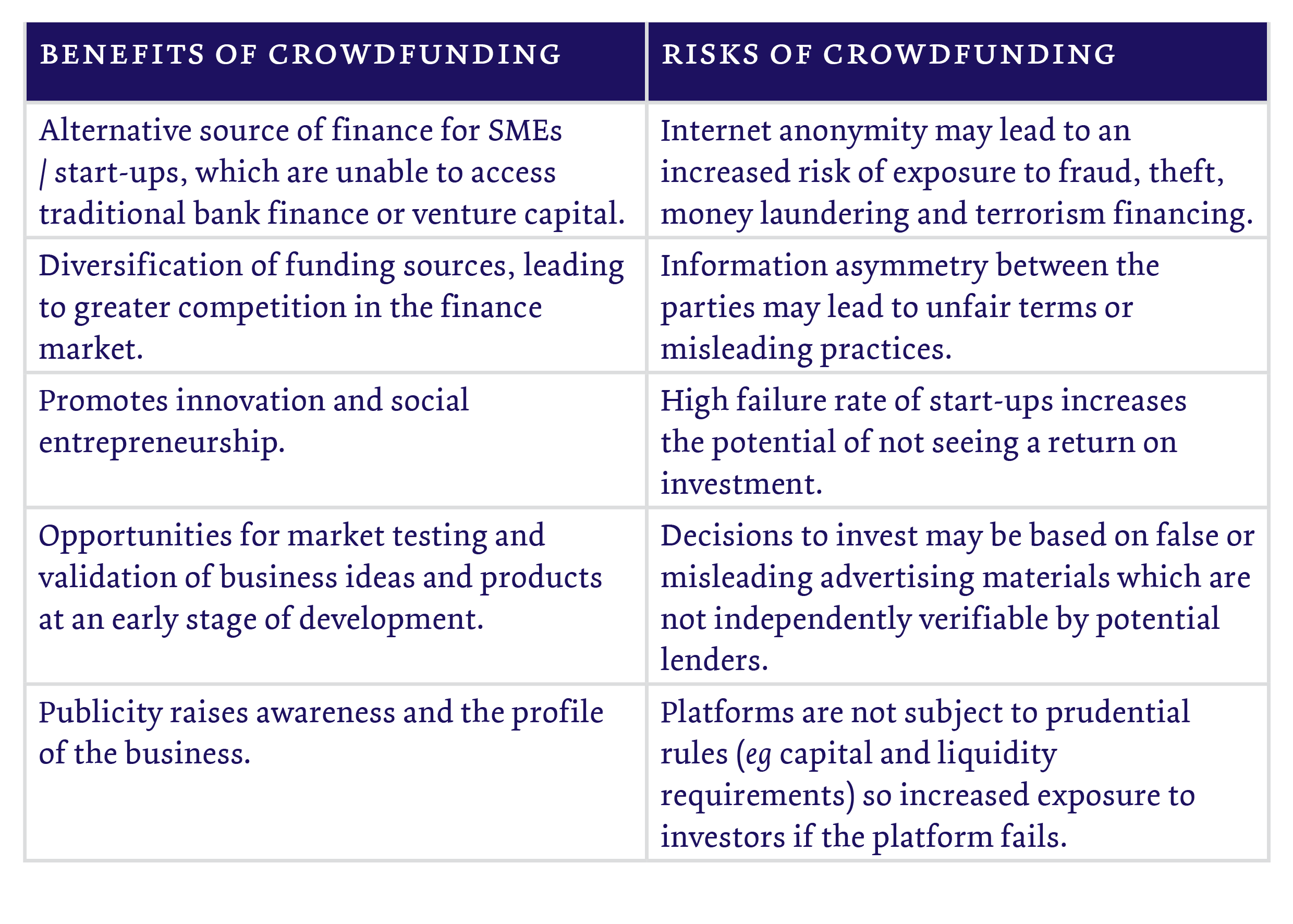

Crowdfunding is an innovative, marketbased source of finance, which can provide consumers and small investors with access to investment opportunities that offer a higher rate of return than is generally available from traditional credit institutions. However it is also associated with a number of risks. In its consultation paper, the Department identifies several benefits and risks associated with crowdfunding, as set out in the table below:

Is crowdfunding currently regulated in Ireland?

Crowdfunding is not specifically regulated in Ireland, although certain types of investment crowdfunding platforms may potentially be affected by existing legislation, such as the European Communities (Markets in Financial Instruments) Regulations 2007. In June 2014, the Central Bank of Ireland issued an information notice which alerted consumers to certain risks of crowdfunding and its lack of regulatory oversight.

A number of EU member states, including Austria, Belgium, Finland, France, Germany, Italy, the Netherlands, Portugal, Romania, Spain and the United Kingdom, have introduced domestic legislation to regulate crowdfunding.

The EU itself does not regulate crowdfunding and the European Commission has indicated that it does not intend to introduce EU laws to regulate crowdfunding at the moment. However it will continue to review developments in the sector so that it can reply in a timely manner if closer alignment between national regulations becomes necessary.

In the Commission’s recent report to the Council of the EU and the European Parliament on accelerating the capital markets union, dated 24 March 2017, the Commission invited the member states to consider whether national crowdfunding legislation provides an effective and proportionate level of investor and consumer protection while permitting cross-border activity. Moreover, towards the end of 2016, the European Commission issued a negotiated call for tender to obtain an assessment of the potential for the development of cross-border crowdfunding business in the EU, and how existing EU legislation applies and interacts with existing and upcoming national regulatory frameworks in cross-border situations.

This assessment will consider the potential of crowdfunding (both investment-based and loan-based) as a source of funding for European businesses, as well as investor protection aspects.

What is the consultation about?

In the consultation issued on Friday, 21 April 2017, the Department of Finance is seeking the views of interested parties on whether or not a regulatory regime for crowdfunding would be appropriate, in light of the requirements and costs it could impose on the crowdfunding market. Interested parties are invited to respond to ten specific questions, as well as to submit general comments about any aspect of the costs and benefits of regulating financial crowdfunding compared to the present situation that they deem relevant along with any other policy measures that could be taken.

The consultation paper is available here.

What happens next?

The closing date for receipt of submissions to the consultation is 2 June 2017. The Department intends to use the submissions received during the consultation to inform the future development of regulatory policy on crowdfunding in Ireland.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below