New EMIR Margin Requirements for Uncleared OTC Derivatives

The new EMIR margin requirements for uncleared over the counter (OTC) derivatives are being phased in over the new few years, starting from 4 February 2017. This follows the entry into force of Commission Delegated Regulation 2016/2251 (the “Delegated Regulation”) on 4 January 2017 (here).

Why does EMIR impose margin requirements for uncleared OTC Derivatives?

After the financial crisis, the G20 committed to reducing the systemic risk stemming from OTC derivatives, including through the introduction of margin requirements. EMIR reflects the EU’s commitments in this area and requires parties to exchange both initial margin (“IM”) and variation margin (“VM”) with respect to their uncleared OTC derivatives transactions. Essentially IM is designed to cover potential future credit exposure of a party to its counterparty, while VM protects against trade exposures arising from market fluctuations.

Which types of transactions are covered?

The margin requirements apply to all OTC derivative contracts within the meaning of EMIR that are not cleared by a “CCP” or central counterparty and which are entered into at a time when both parties are past the EMIR phase-in date applicable to them.

FX forwards, FX swaps and cross-currency swaps are all in-scope, but are subject to certain derogations. IM requirements do not apply to uncleared physically settled FX forwards, FX swaps and the exchange of principal of uncleared currency swaps, each as more particularly described in the Delegated Regulation. VM requirements apply on a delayed basis described below. Spot FX are excluded from the scope of EMIR and, therefore, from the scope of the Delegated Regulation.

When will the margin requirements apply?

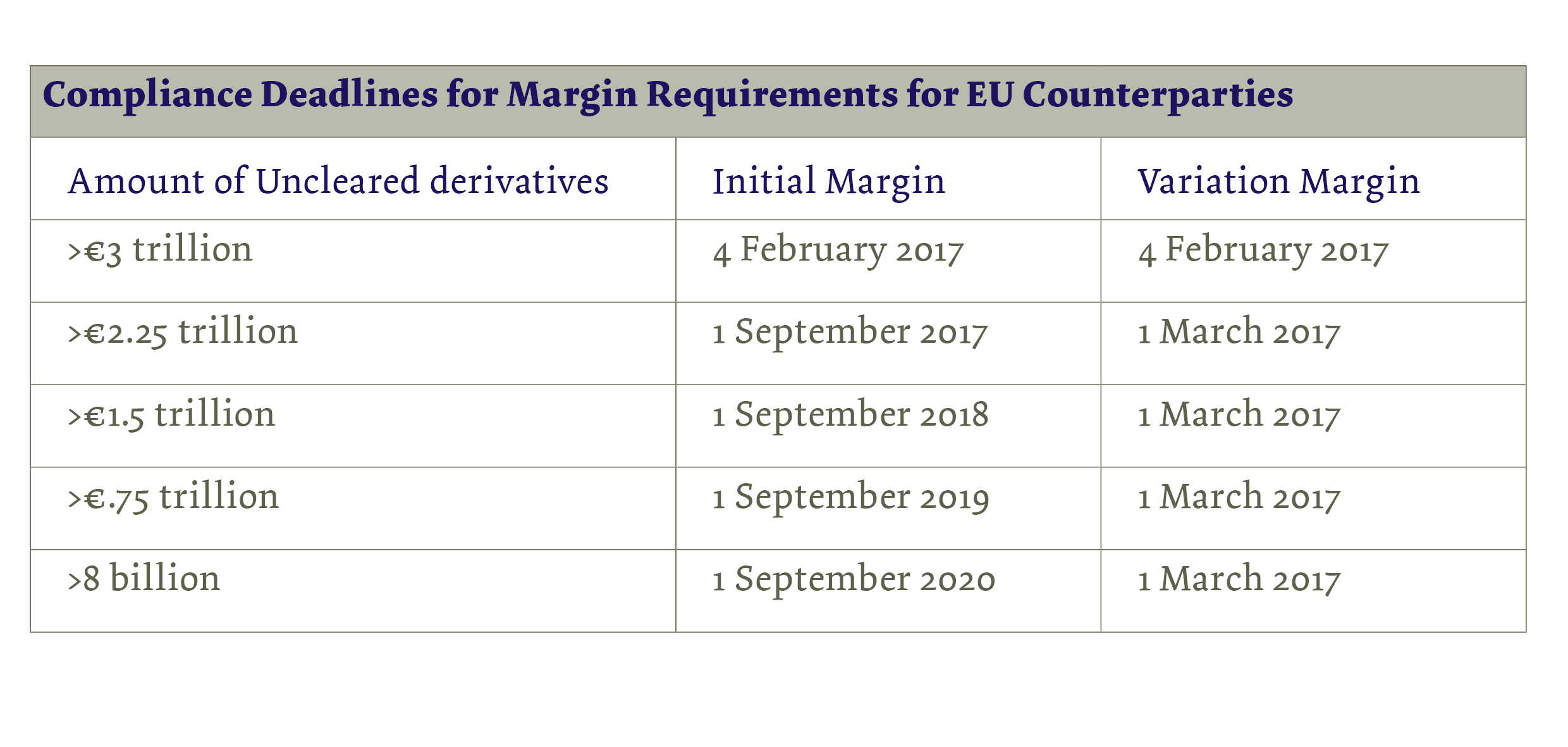

The Delegated Regulation entered into force on 4 January 2017. Parties that have, or belong to groups that have, over €3 trillion of uncleared OTC derivatives were to start exchanging both IM and VM from 4 February 2017.

Other users of derivatives will start to exchange VM from 1 March 2017. IM obligations for parties that have, or belong to groups that have €3 trillion or less, but more than €8 billion, of uncleared derivatives will be phased in between 1 September 2017 and 1 September 2020 (see table below). Parties that have, or belong to groups that have, €8 billion or less in uncleared derivatives are exempt from the requirement to calculate, collect and provide IM. The thresholds referred to are determined by reference to the aggregate average notional amount of the relevant derivatives, calculated in accordance with a methodology set out in the Delegated Regulation (“AANA”).

The application of the VM requirements to uncleared physically settled FX forwards is delayed until a date determined by reference to a Commission Delegated Regulation adopted under the MiFID II Directive 2014/651 which, among other matters, clarifies the ambit of the spot FX excluded from, and the FX forwards encompassed by, the ambit of MiFID II. According to that MiFID II Delegated Regulation, for most major currencies, a spot contract is a contract for the exchange of currency against another currency where delivery is scheduled to be made within two trading days (see our related briefing on the draft Delegated Regulation here). The MiFID II Delegated Regulation is currently awaiting publication in the EU’s Official Journal. Assuming it is published and enters into force in accordance with its terms, the most likely date of application of the VM requirements to uncleared physically settled FX forwards is 3 January 2018.

Are any of the margin requirements subject to specific implementation provisions?

Certain types of OTC derivatives contracts are subject to specific implementation provisions. These include the FX transactions mentioned above and intragroup transactions, which are discussed further below. In addition:

- covered bond issuers and similar covered pools are not required to post or collect IM, or VM, when entering into OTC derivatives to hedge interest rate or currency mismatches between the cover pool and covered bonds once certain conditions are satisfied; and

- single-stock equity options and index options are subject to a three year exemption from the VM and IM requirements, i.e. until 4 January 2020.

Who is affected by the margin requirements?

Generally, the margin requirements apply to any entity which is an EMIR “financial counterparty” (“FC”)2 or a non-financial counterparty (“NFC”). Certain entities are exempt from EMIR in whole or part, including members of the European System of Central Banks and certain multilateral development banks and public sector entities that are owned by central government or have government guarantees.

Parties are not required to exchange collateral where one of them is an NFC with uncleared OTC derivatives below the EMIR clearing thresholds (“NFC-”)3, a third country entity (“TCE”) that would be an NFC- if established in the EU, or a CCP authorised as a credit institution in the EU.

As mentioned above, derivatives between parties either or both of which has, or belongs to a group which has, an aggregate AANA of €8 billion or less are exempt from the IM requirements.

What is a netting set?

Margin must be collected equal to the value of all of the OTC derivative contracts in a netting set. The Delegated Regulation defines a “netting set” to mean “a set of non-centrally cleared OTC derivative contracts between two parties that is subject to a legally enforceable bilateral netting agreement” such as an ISDA Master Agreement.

Where a party is subject to the margin requirements of a jurisdiction other than an EU member state, its netting sets may comprise all the non-centrally cleared OTC derivative contracts encompassed by the netting set that are subject to exchange of collateral in that jurisdiction, even if not all of those contracts are encompassed by the EMIR margin requirements.

What collateral can be posted?

In order to be eligible for IM/VM, collateral must be sufficiently liquid and not exposed to excessive credit, market or FX risk.

Eligible collateral includes, for example, cash, allocated gold, certain debt securities, certain covered bonds, corporate bonds, certain equities, the most senior tranche of certain securitisations and, in certain circumstances, shares or units in UCITS. Additional requirements apply in respect of certain such types of assets.

What requirements apply to Variation Margin (VM)?

The Delegated Regulation prescribes the amount of VM to be calculated, frequency of calculation and how the date by reference to which it is to be calculated is determined. Briefly, VM must be calculated daily by reference to the previous day’s values of contracts in the relevant netting set, and provided, with certain exceptions, within the same day of the calculation date. This time period may prove challenging for many buy-side parties. However earlier drafts of the Delegated Regulation proposed that the obligation would be to collect VM within this time frame. It is generally understood by the market that the change was intended to substitute the originally proposed obligation to settle VM within the prescribed time frame with an obligation to give within that time frame all instructions required to effect such settlement of VM within the normal settlement cycle.

What requirements apply to Initial Margin (IM)?

IM can be calculated using the standardised approach (which is similar to the mark to market approach), or by using IM models referred to in the Delegated Regulation, or both; parties must agree on the method that each party uses to determine the IM it must collect but they do not need to agree on a common methodology. ISDA has produced a “Standard Initial Margin Model (SIMM) TM”; an IM methodology that can be licensed by parties from ISDA and used by them to calculate IM. ISDA (SIMM)TM is structured to enable updating to reflect adjustments and recalibrations required from time to time in accordance with a transparent, centralised governance process.4

IM amounts must be calculated at a minimum every ten business days or upon the occurrence of certain specified events, including where a new in-scope OTC derivative contract forming part of the relevant netting set is executed or an existing one expires. As with VM, IM must be provided within the business day of calculation.

IM must be segregated from the collecting party’s proprietary assets and held by a third party custodian or under another legally binding arrangement to ensure that it is protected from the default or insolvency of the collecting party. Cash IM must be deposited in an account with a central bank or third party credit institution authorised in accordance with CRD IV, or in a third country with equivalent supervisory and regulatory arrangements, that is not in the same corporate group as either party.

Collateral collected as IM may not be re-used or re-hypothecated, although a third party custodian may use cash IM for reinvestment purposes.

Non-cash IM is subject to concentration limits on securities issued by a single issuer or entities belonging to the same group and on equity and equity-linked securities.

The IM collected may be reduced in certain circumstances. Specifically, parties may provide in their risk management procedures that IM collected is reduced by an amount up to €50 million where neither counterparty belongs to any group, or where they are part of different groups. Where both parties are part of a single group the threshold is reduced to €10 million. Where a party that is part of a group to which its counterparty does not belong relies on this, its risk management procedures must provide for monitoring at group level whether the threshold is exceeded and the retention of relevant records.

Can parties apply a minimum transfer amount when exchanging collateral?

Yes, an exchange of collateral is only necessary if the change in the margin requirements exceeds €500,000 (or its equivalent in another currency). This threshold applies on a counterparty basis. Separate minimum transfer amounts may be applied to each of VM and IM but the sum of these should not exceed €500,000.

This is a floor; if the minimum transfer amount is exceeded the entire amount, and not just the excess, must be transferred.

What procedures need to be implemented for posting collateral?

Parties must put in place detailed, transparent and robust operational processes to ensure the timely transfer of collateral. These should include:

- clear internal policies and standards in respect of collateral transfers;

- clear senior management reporting;

- requirements to ensure sufficient liquidity of the collateral; and

- processes to ensure that any deviation from those policies is rigorously reviewed by all relevant internal stakeholders that are required to authorise deviations.

What exemptions apply to intragroup transfers?

Pursuant to EMIR, intragroup OTC derivative contracts are exempt from the requirements to exchange both VM and IM where there are no practical or legal impediments to the transferability of their own funds and the repayment of liabilities between the relevant group entities party thereto and the risk management procedures of those parties are adequately sound, robust and consistent with the level of complexity of the contracts. The Delegated Regulation includes detailed requirements which must be fulfilled before this exemption is granted; an application must be made to the competent authority of any EU member state of establishment of a party.

All intragroup transactions are exempt from the requirement to exchange VM and IM until the 4 July 2017. In addition, in the case of IM, there is a separate three year transitional exemption for intragroup transactions with entities outside the EU while waiting for the Commission to make an equivalence determination for the relevant third country. The Commission has published an amending Delegated Regulation which will, if adopted, provide for a similar three year exemption in the case of VM. See our related briefing here.

Documentation and required legal reviews

In-scope parties transacting in-scope OTC derivative contracts will need to enter into new, or amend existing, documentation to ensure compliance with the new margin requirements.5 ISDA has produced documentation and processes to assist parties in satisfying these requirements. Inscope parties must also establish detailed risk management procedures.

Independent legal reviews of the enforceability of netting (in order to collect collateral net) and the segregation of IM are required. ISDA is in the process of extending its existing suite of legal opinions to encompass its new VM and IM documentation and obtaining new opinions on the enforceability of the rights of a collateral provider to recover IM from a collateral taker. The enforceability of IM custodial arrangements, and the implications of custodial insolvency, are outside the ambit of the ISDA exercise in this regard.

- Directive 2014/65/EU of the European Parliament and of the Council of 15 May 2014 on markets in financial instruments and amending Directive 2002/92/EC and Directive 2011/61/EU, OJ L 73, 12 June 2014, p. 349

- Certain banks, investment firms, insurance undertakings, UCITS Management Companies, pension funds and alternative investment funds with managers authorised or registered under the Alternative Investment Fund Managers Directive 2011/61

- The thresholds are as follows; credit/equity derivatives - €1bn; interest rate/FX derivatives - €3bn; commodity derivatives and any other OTC derivatives contracts not otherwise provided for - €3bn (combined threshold)

- See further http://www2.isda.org/functional-areas/wgmr-implementation

- Information on related ISDA initiatives is available here: http://www2.isda.org/functional-areas/wgmrimplementation/

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below