New EU Market Abuse and Inside Information Regime - What do Irish issuers need to do?

The EU Market Abuse Regulation (596/2014) (“MAR”) takes effect in member states across the EU, including Ireland, on 3 July 2016.

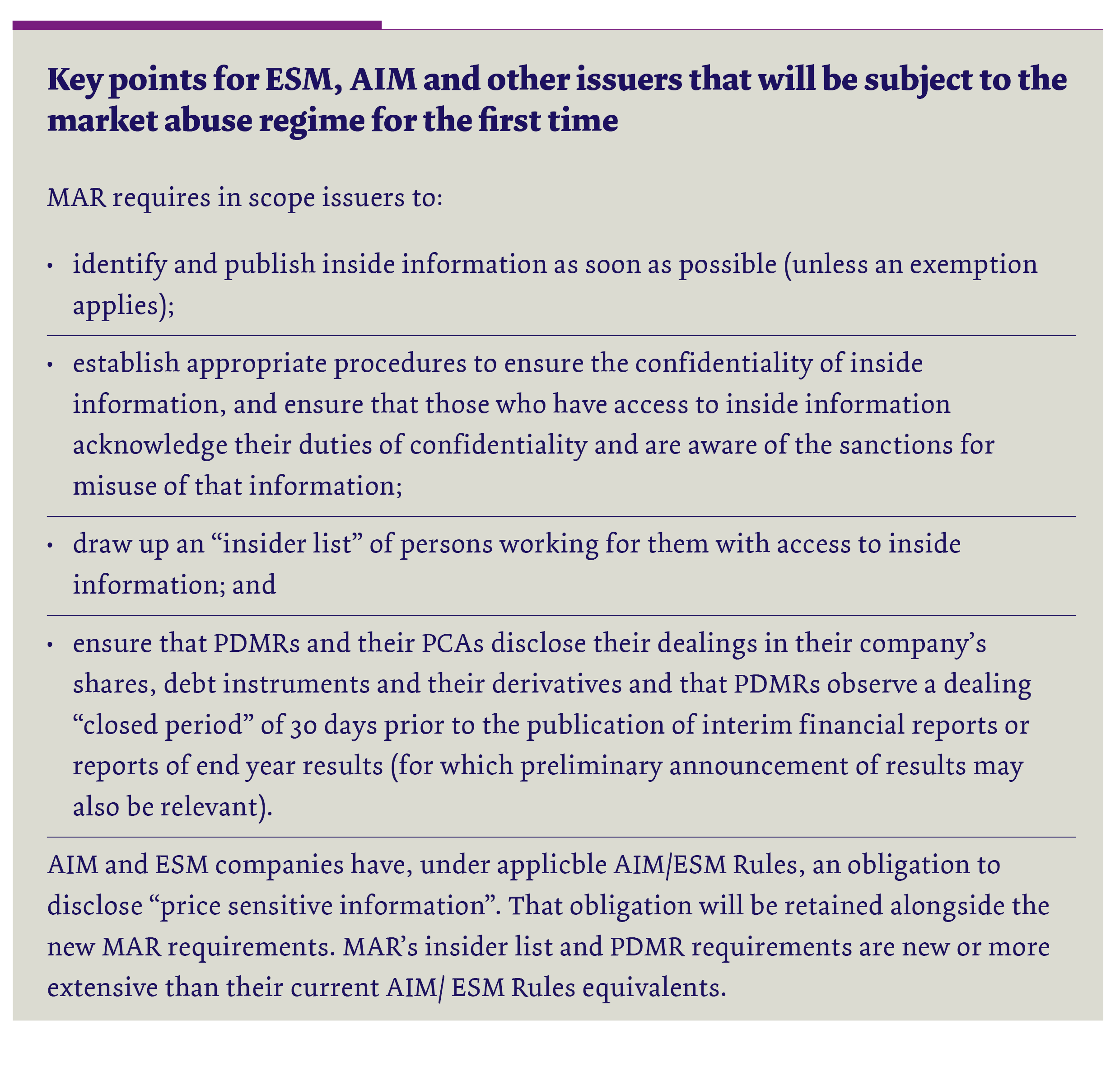

MAR will extend the application of the existing market abuse and inside information regime beyond issuers with shares admitted to trading on EU regulated markets, such as the Main Market of the Irish Stock Exchange, to include issuers of securities traded on multilateral trading facilities, including the Irish Stock Exchange’s ESM and the London Stock Exchange’s AIM.

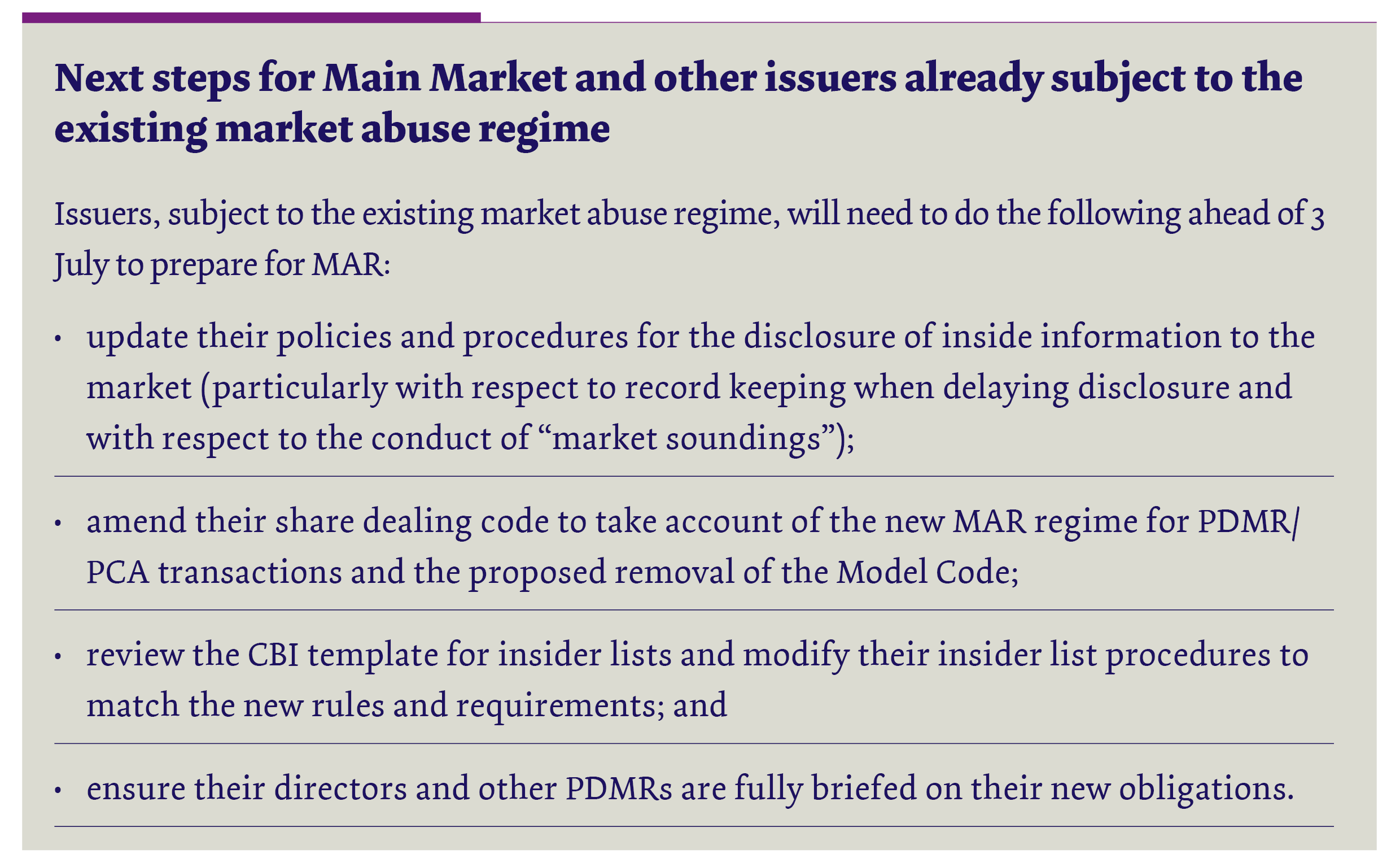

Issuers that are subject to the existing regime will be required to revise significantly their practices and procedures, particularly with respect to the control and disclosure of inside information, monitoring of share dealings by senior executives and maintenance of insider lists.

This briefing summarises the new regime.

Introduction

With the stated aim of establishing a uniform, stronger framework to preserve market integrity, the EU Market Abuse Regulation (596/2014) (“MAR”) and the Criminal Sanctions for Market Abuse Directive (2014/57/EU) (“CSMAD”) will, from 3 July 2016, replace the EU Market Abuse Directive (2003/6/EC) (“MAD”), which has operated since 2005, and its implementing measures. (CSMAD complements MAR by introducing minimum rules for criminal sanctions for market abuse.)

As an EU regulation, MAR has direct effect in Ireland and will be effective from 3 July 2016 without enactment of any domestic Irish legislation. The aim is to create a single, directly applicable, EU market abuse rulebook. Ireland will need to amend, and where appropriate, repeal provisions of Irish law which apply the current market abuse regime in order to reflect MAR.

MAR will be supplemented by a wide range of delegated regulations, binding technical standards and guidelines to be adopted by the European Commission and the European Securities and Markets Authority (“ESMA”). These measures - which at the date of this briefing largely remain in draft - are central to the new regime as they will set out the detail as to how MAR is to be implemented, in practice, by issuers and other market participants in such areas as the control and disclosure of inside information, the maintenance of ‘insider lists’, the protocols for conduct of ‘market soundings’ and the circumstances in which dealings during a ‘closed period’ by PDMRs may be permitted.

Scope of MAR

MAR extends the application of the market abuse regime beyond conduct related to financial instruments (including shares, bonds and other transferable securities) admitted to trading on an EU regulated market (or for which a request for admission to trading on a regulated market has been made) to cover financial instruments traded on multilateral trading facilities (“MTFs”) (or for which a request for admission to trading on an MTF has been made) and organised trading facilities (“OTFs”). Financial instruments, such as credit default swaps and contracts for difference, the price or value of which depends on or has an effect on the price or value of any such financial instrument are also covered. Conduct which can have an effect on such financial instruments whether it takes place on a trading venue or over the counter (“OTC”) is caught.

MAR extends the market abuse regime to abusive trading in spot commodity contracts, emission allowances and related auctioned products and benchmarks (including inter-bank offer rates) and in derivatives referenced to such securities. Application of MAR to these instruments is outside the scope of this note. Certain of these provisions are not effective until 3 January 2017.

MAR has extra-territorial effect and covers actions taken whether within or outside the EU in relation to financial instruments within MAR’s scope.

What is inside information?

“Inside information” is defined in MAR broadly in the same way as in the current MAD regime (but has been widened to capture inside information for commodity derivatives and emission allowances).

Information to be “inside information” must:

- be precise;

- have not been made public;

- relate, directly or indirectly, to an issuer or its financial instruments; and

- if made public, be likely to have a significant effect on the price of those financial instruments or on the price of related derivative financial instruments.

A “reasonable investor” test is incorporated in the definition. Information which, if made public, would be likely to have significant effect on the price of financial instruments means information a reasonable investor would be likely to use as part of the basis of his or her investment decisions.

Under MAR, information is considered “precise” if it indicates a set of circumstances which exist or which may reasonably be expected to come into existence or an event which has occurred or which may be reasonably be expected to occur and where the information is specific enough to enable a conclusion to be drawn as to the possible effect of that set of circumstances or event on the prices of the financial instruments. Reflecting European case law on the assessment of what amounts to inside information under MAD, MAR now confirms that, in the case of a protracted process that is intended to bring about, or that results in, particular circumstances or a particular event, each stage of the process, as well as the overall process, the future circumstances or event may be deemed to be precise information. In sum, an intermediate stage leading up to a particular event (for example, information as to the status of contract negotiations) can be inside information, if it meets the criteria for inside information.

MAR confirms, in its recitals, that there is a rebuttable presumption that a person is deemed to have ‘used’ inside information when dealing while in possession of inside information. MAR specifies circumstances where no such presumption exists (eg in the case of market makers or where there are “ethical walls” in place).

Disclosure of inside information by companies with traded securities - the “legitimate interests” exception

MAR requires, as MAD does, companies with traded securities in scope for MAR (in this briefing, “issuers”) to disclose inside information directly concerning them to the public as soon as possible.

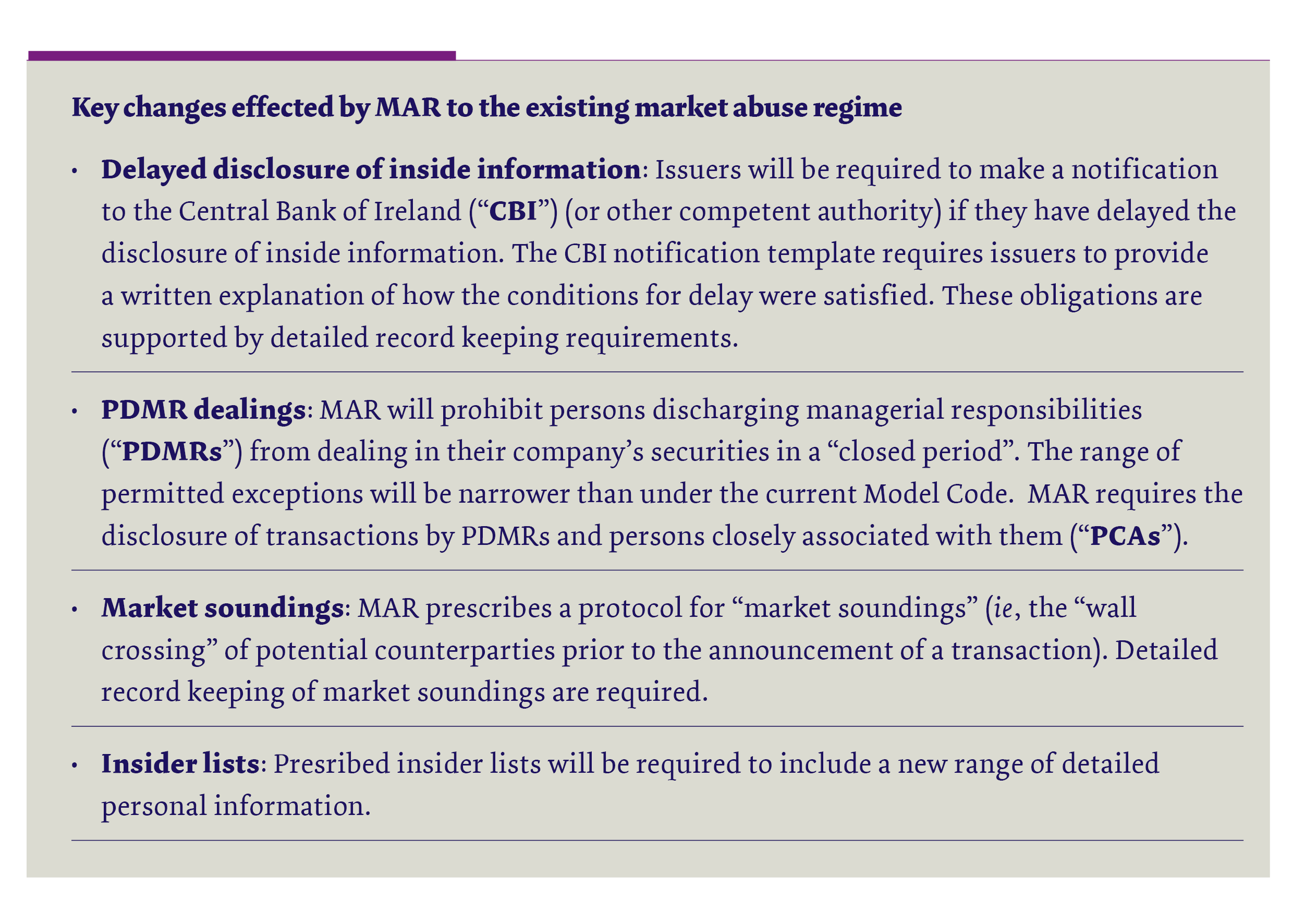

Under MAR, an issuer will still be able to delay announcing inside information so as not to prejudice its “legitimate interests” provided that the conditions to delay are met (including that the information can be kept confidential and that delayed disclosure would not be likely to mislead the market). However, where an issuer delays disclosure of inside information for this reason, there is a new requirement that the issuer inform its regulator in writing of its decision to delay announcement immediately after the information is disclosed to the public. MAR also requires issuers to provide its regulator with a written explanation of how the conditions for delay were satisfied in respect of the delay of the particular piece of inside information (although MAR allows member states to specify that such an explanation be required only if the regulator requests it, rather than on every occasion; it is not yet clear how Ireland will exercise this discretion).

Draft ESMA technical standards (which have not yet been formally adopted by the European Commission) set out details of the internal records that issuers are expected to maintain where the announcement of inside information has been delayed. These standards are detailed and prescriptive and would require issuers to maintain records as to:

- the dates and times when the inside information first existed within the issuer, when the decision to delay announcement was made, and when the issuer is likely to disclose such information;

- the identity of the persons within the issuer responsible for:

- deciding to delay the information;

- ensuring the ongoing monitoring of the conditions for delay;

- deciding when public disclosure should be made; and

- providing requested information about the delay and a written explanation of the basis for the delay to the regulator; and

- evidence of the initial fulfilment of the conditions permitting delay.

It will, therefore, be critical that, where an issuer delays the public disclosure of inside information under MAR, it will have in place appropriate procedures and arrangements for the monitoring of the conditions for delay and the keeping of a detailed record of the circumstances warranting the delay.

The new requirements may preclude issuers from maintaining the approach (that in our experience is taken by many issuers and which can be operationally convenient) of “erring on the side of caution” by treating information as inside information without concluding that it is in fact so.

ESMA is required under MAR to issue guidelines on the identification of “legitimate interests” that would entitle issuers to delay the disclosure of inside information. Draft ESMA guidelines identify six (non-exhaustive) categories where the legitimate interests of the issuer are likely to be prejudiced by immediate disclosure of inside information. In practice, the principal category will likely remain circumstances where the issuer is conducting negotiations and where the outcome of such negotiations would likely be jeopardised by immediate public disclosure of that information. One newly identified category of “legitimate interests” that may be prejudiced by early disclosure is where a transaction previously announced is subject to a public authority’s approval, and such approval is conditional upon additional requirements, and where the immediate disclosure of those requirements would likely affect the ability of the issuer to meet them and therefore prevent the final success of the deal or transaction. MAR recognises that credit institutions or financial institutions may delay the disclosure of inside information in order to preserve the stability of the financial system, for example, in circumstances where there is a temporary liquidity problem.

The proposed guidelines will clarify that delay of disclosure is likely to mislead the public where the inside information is materially different from a previous public announcement of the issuer or from the market’s expectations, where such expectations are based on signals that the issuer has previously set.

Market soundings

MAR introduces a new “safe harbour” framework for legitimate disclosure of inside information in the course of “market soundings” that will further formalise the practice of “wall-crossing” potential counterparties.

Under MAR, “market soundings” comprise the communication of information, before the announcement of a transaction, to one or more potential investors in order to engage the interest of those potential investors in the possible transaction and the conditions relating to it, such as its potential size or pricing. (A potential bidder may also conduct “market soundings” with shareholders in the target where an assessment of the willingness of such shareholders to sell their shares is reasonably required by the bidder in deciding whether to make the bid; such “market soundings” are also regulated by takeover regulations.)

For the “market soundings” safe harbour to apply, certain disclosure and record keeping conditions must be met. Again, the protocol to be followed will be prescribed in detail by ESMA technical standards.

According to MAR, before conducting a “market sounding”, the issuer (or other “disclosing market participant”, including any broker or bank acting on its behalf) must specifically assess whether the market sounding will involve the disclosure of inside information, and must make a written record of its determination which is to be made available to the regulator on request.

Before disclosing inside information to a potential investor, the issuer (or other “disclosing market participant”) must “wall-cross” the potential investor. Under MAR, the disclosing market participant must, in sequence: obtain the consent of the potential investor to receive inside information; inform the potential investor that it will be prohibited from using the information or attempting to use that information by dealing for itself or a third party, directly or indirectly; and inform the potential investor that it will be obliged to keep the inside information confidential.

Detailed records must be maintained of all information given to potential investors receiving a “market sounding” and those records must be provided to the regulator authority upon request. These records must be kept for five years. Technical standards (currently in draft) will prescribe in significant detail a protocol for conduct of “market soundings”. The draft technical standards envisage a highly prescriptive framework including rules on use of scripts and recorded telephone lines, maintenance of “sounding lists” of persons to whom information has been disclosed, their contact details and the date and time of all relevant communications, and “cleansing” procedures. Where “market soundings” take place during unrecorded meetings or telephone conversations, written notes should be kept in accordance with uniform, prescribed templates.

There is a specific requirement under MAR to inform the potential investor as soon as possible once the information disclosed in the course of a “market sounding” ceases to be inside information.

PDMR dealings and the MAR “closed period”

MAR, as MAD, requires public disclosure of transactions in shares, debt instruments and derivatives or other financial instruments linked to them by “persons discharging managerial responsibilities” (“PDMRs”) and “persons closely associated with them”.

The definition of PDMRs and “persons closely associated with them” is unchanged from MAD. (A person “discharging managerial responsibilities” is a director of the issuer or a senior executive, not being a director, who has regular access to inside information concerning the issuer and has power to make managerial decisions affecting the issuer’s future development and business prospects; “persons closely associated” include the spouse and dependent children of the PDMR, any relative who has shared the same household for at least one year and companies controlled by the PDMR and certain other associated companies.)

All transactions on the PDMR’s or associated person’s “own account” fall to be disclosed. Addressing an issue that had arisen under MAD, MAR clarifies that the pledging or lending of financial instruments is a transaction on “own account” for this purpose, as is trading undertaken by a portfolio manager, with or without discretionary authority, for the PDMR or associated person.

Disclosures are to be made by the PDMR or associated person to the issuer and the regulator within three business days of the transaction. The issuer in turn must make that information public within that same period of three business days of the transaction.

A de minimis threshold will apply so that the disclosure requirement does not apply to transactions by a PDMR with a value less than €5,000 per calendar year in aggregate (which threshold Ireland and other member states have discretion to increase to €20,000). It is the responsibility of a PDMR to keep track of undisclosed transactions so that the PDMR knows when the threshold has been reached or exceeded and then to disclose each subsequent transaction.

In a significant change, MAR expressly prohibits trading by PDMRs in “closed periods”, save in limited, specified circumstances. PDMRs may not conduct transactions on their own account or for the account of a third party during a closed period of 30 calendar days before the announcement of an interim financial report or year-end report (which the issuer is obliged to make public according to the rules of the trading venue on which the issuer’s shares are admitted to trading or national law).

As the new regime materially crosses-over with the application of the Model Code, as annexed to the Listing Rules of the UK’s FCA and applicable to premium listed companies, the FCA proposes to remove the Model Code from 3 July 2016. It is anticipated that the Irish Stock Exchange will do likewise with respect to the Model Code annexed to its Listing Rules. Supplementing MAR, the FCA proposes to introduce new rules requiring premium listed companies to have effective systems and controls regarding PDMR’s securities dealing clearance procedures and, in particular, requiring PDMRs to obtain clearance before dealing in their company’s securities at any time (and not just during MAR’s “closed periods”). It might be anticipated that the Irish Stock Exchange would take a similar approach.

MAR does permit dealings by PDMRs during a “closed period” in certain circumstances, with the issuer’s consent, including where there are exceptional circumstances, such as severe financial difficulty, which require the immediate sale of shares. Transactions during a “closed period” under employee share schemes or where the beneficial interest in the relevant security does not change may also be permitted by the issuer. Supplementing MAR, the Commission has published a detailed draft delegated regulation which includes a non-exhaustive list of employee share scheme dealings that may be permitted during “closed periods”. In broad terms, most of the share scheme-related dealings that are currently permitted by the Model Code during a Model Code “prohibited period” should be permitted in a MAR “closed period” but, inevitably, there will be differences in practice.

At a minimum, issuers will be required to update their share dealing policies and procedures (which are typically based on the provisions of the Model Code) to take account of the implementation of MAR and the removal of the Model Code.

Insider Lists

The existing requirement of MAD that an issuer maintain an insider list of persons working for it with access to inside information, relating directly or indirectly to the issuer, whether on a regular or occasional basis, will be preserved under MAR. This general requirement will be supplemented by technical standards, prepared by ESMA, prescribing the precise format of the insider list to be maintained.

Issuers will, as is current practice, be able to split their insider list into two parts: a standing list, listing permanent insiders, and a transaction-specific list or lists, listing, on a case-by-case basis, those persons within the issuer who have access to inside information in relation to a specific transaction or event.

ESMA technical standards (currently in draft) specify the format and contents of the insider list on a more prescriptive basis than currently. In particular, it is envisaged that the insider list record: the birth name of the insider (if different to current name); professional telephone numbers, direct dial and mobile; date of birth; national identification number (if applicable) and personal telephone numbers, all of which information is additional to that routinely recorded in insider lists. MAR continues to require that issuers take all reasonable steps to ensure that any person on the insider list acknowledges in writing the legal and regulatory duties that this entails.

The insider list requirement has proven to be burdensome in practice and these new requirements will create an additional burden for issuers.

What is market abuse?

MAR will widen the market abuse regime to regulate conduct related to securities traded on multilateral trading facilities (“MTFs”) (or for which a request for admission to trading on an MTF has been made) and organised trading facilities (“OTFs”), as well as securities admitted to trading on an EU regulated market (or for which a request for admission to trading on a regulated market has been made).

“Market abuse” means insider dealing and market manipulation. MAR prohibits:

- engaging or attempting to engage in insider dealing (that is, using inside information by acquiring or disposing of, for own account or account of a third party, securities to which the information relates; using inside information to cancel or amend an order placed before the person possessed the inside information is also caught);

- recommending or inducing another person to engage in insider dealing;

- unlawfully disclosing inside information (that is, other than in the normal exercise of a person’s employment, profession or duties); and

- market manipulation and attempted market manipulation.

Market manipulation is committed, for example: where a person effects transactions or orders to trade which give, or are likely to give, false or misleading signals about the supply of, or demand for, or price of financial instruments or which secure the price of such instruments at an abnormal level (other than for legitimate reasons and in conformity with accepted market practices); effects transactions or orders to trade which employ fictitious devices or any other form of deception or contrivance; or disseminates false or misleading information about financial instruments.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below