Irish Merger Control 2025 – Key Takeaways

2025 Key Trends

Further increase in the number of notified deals

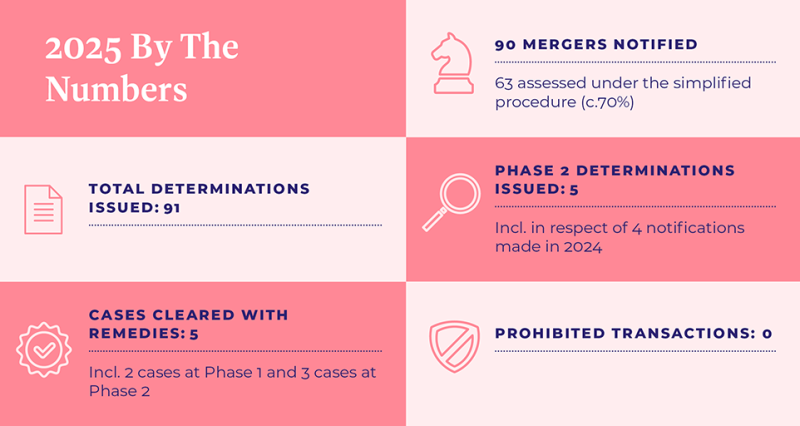

There were 90 transactions notified to the CCPC in 2025, up from 82 in 2024 and 68 in 2023, marking a continued upward trajectory in the number of deals being notified to the CCPC. The number of notifications in 2025 represents a 9.76% increase on 2024, while the 2024 total was a 21% increase on 2023. The increased workload of the CCPC is among the reasons it has called for higher financial thresholds for mandatory merger notification in Ireland (see below), which it says would enable it to ‘focus resources on transactions that are more likely to raise competition issues’.1

Majority of deals notified under the simplified procedure

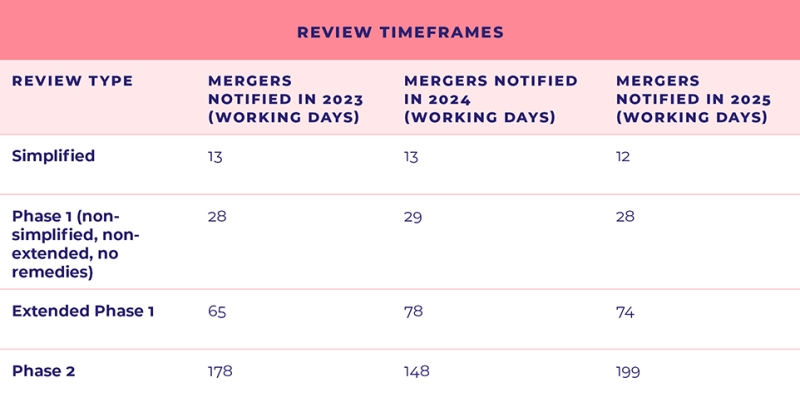

In 2024, 71% of all notifications submitted were reviewed under the CCPC’s Simplified Merger Notification Procedure. In 2025, this trend remained consistent with 70% of notifications submitted reviewed by the CCPC pursuant to its simplified procedure. Clearance times under the simplified regime remain broadly consistent with the previous two years, with simplified, no issue deals being cleared, on average, within 12 working days from the date of notification (down from 13 working days in 2023 and 2024).

Deal timelines

The timeframes for the CCPC’s review of Phase 1 notifications was generally in line with the timeframes achieved in the past two years. In fact, there were slightly reduced timelines across all categories of Phase 1 review while Phase 2 review periods were 35% longer than in 2024 and 12% longer than in 2023. The table below shows the average clearance timeframes since 2023 as published by the CCPC in its Mergers and Acquisitions Report 2025 (“Mergers and Acquisitions Report”):

Continued scrutiny for complex deals, and majority of Phase 2 clearances made subject to remedies

The CCPC issued five Phase 2 determinations in 2025, of which one was notified in 2024. Of the five 2025 determinations, the CCPC issued clearance subject to legally binding commitments in three. In its Mergers and Acquisitions Report, the CCPC noted that one Phase 2 notification has also carried over to 2026.

In two cases this year, the CCPC accepted commitments during the Phase 1 review period. Particularly interesting is the KAES/ Bord na Móna Recycling review, in which the CCPC closed the review at Phase 1 with structural (divestment) remedies. Notwithstanding that there is clear remedy precedent in this sector, this demonstrates a willingness on the part of the CCPC to work with parties that engage early in the review process.

Two mandatorily notifiable transactions filed with the CCPC post-completion

In Klass Energy/McMullen Oils (M/25/015), the parties notified the CCPC in February 2025 of a transaction which had completed on 26 September 2023. On 3 March 2025, the CCPC issued a statement, reiterating that a transaction put into effect in contravention of the mandatory notification requirements in section 19(1) of the Competition Act is void unless and until the CCPC makes a determination under section 21 or 22 that it may be put into effect. The transaction was ultimately cleared on 9 April 2025. Barrett Steel/Duggan Steel (M/25/076) was also notified to the CCPC post‑completion. Again, the CCPC issued a public statement regarding the late notification and went on to clear the deal on 19 December 2025.

Spike in the number of media merger notifications 2025

In 2025, the CCPC reviewed eight media merger notifications, up from three notified in 2024. More than half of the 2025 media merger filings were reviewed under the CCPC’s Simplified Merger Notification Procedure.

In addition to the mandatory notification requirement of media mergers to the CCPC, media mergers are required to be notified to the Minister for Culture, Communications and Sport (“Minister for Culture”) who carries out an assessment of the impact of the merger on the plurality of the media in the State. Changes to the media merger regime are expected in 2026 as Ireland moves to implement the European Media Freedom Act (see below).

No “call-in” in 2025

Since 2023, the CCPC has the statutory power to “call-in” transactions that do not meet the notification thresholds if, in its view, the transaction “may have an effect on competition in markets for goods or services in the State”2. The CCPC has confirmed publicly that, in the two years of possessing this power, it is yet to call-in a transaction for review. In its Mergers and Acquisitions Report, the CCPC confirmed that it has issued RFIs in relation to below threshold transactions to gather more information “in the context of the potential exercise of the CCPC’s call-in powers”. Perhaps 2026 will see the first call in.

What to watch for in 2026

Revised CCPC merger guidelines:

Following the CCPC’s consultation process between September and November 2024 in respect of its Merger Guidelines. The CCPC is aiming to circulate a draft of the revised Merger Guidelines in 2026.

Potential increase to merger notification thresholds:

In 2025, the CCPC proposed an increase to the financial thresholds for merger notification in Ireland to the Minister for Enterprise, Trade and Employment, Peter Burke. Currently, deals involving businesses with combined Irish turnovers of €60 million, and where each of two or more of the businesses has an Irish turnover of €10 million, must be notified to the CCPC. The Department plans to launch a public consultation in respect of the new thresholds in 2026 and, once settled, they hope to implement the higher thresholds within the year.

Reforms to Ireland’s current media merger regime:

On 2 July 2025, the Government approved the General Scheme of the Media Regulation Bill, which would amend the Competition Act to comply with the European Media Freedom Act, an EU regulation that came into force on 8 August 2025. The General Scheme was approved in July 2025 and sent for pre‑legislative scrutiny, with the Government indicating that it is a priority drafting item. If enacted, the Media Regulation Bill would introduce significant changes to the notification criteria and assessment of media mergers in Ireland. Amongst other changes, the Bill will:

- broaden key definitions, including the definition of a) “media business” to include online platforms which provide access to media content; and b) “carries on a media business in the State” to require the media business to have made sales in the State of at least €2 million in the most recent financial year;

- transfer the responsibility for assessing media mergers from the Minister for Culture to Coimisiún na Meán (the Media Commission);

- create a call-in power whereby Coimisiún na Meán can “call-in” transactions not otherwise classified as media mergers if the transaction may significantly impact on media plurality and editorial independence; and

- introduce a new “gun-jumping” offence for media mergers.

If the Media Regulation bill is enacted, we can expect to see a further increase in media merger review.

Ex-Post review of remedies

In its Mergers and Acquisitions Report, the CCPC announced that it plans to initiate an ex-post review of remedies in 2026 to assess the effectiveness of commitments accepted by the CCPC in previous cases. Companies who are subject to obligations under CCPC commitments should prepare for audits of compliance and effectiveness and ensure that such documentation is readily available.

- Statement from Úna Butler, CCPC member as reported in the Irish Legal News article dated 12 January 2026, titled “CCPC calls for increase in merger notification threshold”. [Accessed: here]

- CCPC, “Merger and Acquisitions Procedures: Procedures for the Review of Mergers and Acquisitions under the Competition Act 2002, as amended” dated 1 August 2023 at paragraph 1.7.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below