A Rescue Process for Small and Micro Companies: Sounds Good in Theory but will it Work in Practice?

This briefing was originally published on 27 July 2021 following the enactment of the Companies (Rescue Process for Small and Micro Companies) Act 2021. The Act was commenced on 8 December 2021.

Introduction

The Companies (Rescue Process for Small and Micro Companies) Act 2021 (the “Act”) was signed into law on 22 July 2021. The Act provides for a new administrative rescue process, exclusively available to small and micro companies. In its 2020 Report Advising on a Legal Structure for the Rescue of Small Companies, the Company Law Review Group recognised that one of the main barriers to Examinership for small companies is the costs involved in the Court-led process. In that context, the Act adopts the key principles of examinership to create a new process available to small and micro companies to restructure their debts within 70 days. However, as detailed below, there are some important distinctions from examinership that could fundamentally undermine the process.

Overview of Process

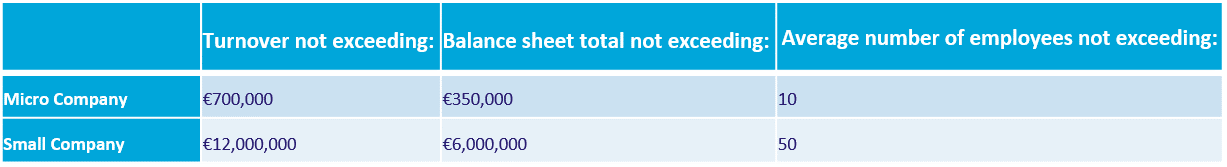

The process is only available to small and micro companies (as defined under sections 280A and 280D respectively of the Companies Act 2014), i.e. those companies that satisfy at least two of the following characteristics:

Step 1 - The eligible company (the “Company”) furnishes a Process Advisor (the “PA”) with a sworn statement of affairs.

Step 2 - If satisfied that there is a reasonable prospect of survival for the Company, the PA prepares a report for the Company akin to an Independent Expert’s Report in Examinership (i.e. addressing the conditions/funding required to allow the Company to continue trading as a going concern) (the “Report”).

Step 3 - Within 7 days of receipt of the Report, the board of directors passes a resolution to appoint the PA.

Step 4 - The PA must notify creditors within two working days of their appointment and request submissions in respect of claims. Should a creditor fail to respond to the request for information, the PA will establish the value of the claim based on the information available to them.

Step 5 - The PA has 49 days to:

- prepare proposals for a rescue plan for the Company, which will likely involve a write-down of debt (the “Rescue Plan”). While the Rescue Plan can write down secured debt, as with Examinership, it cannot (a) write down debt below the value of a creditor’s security or (b) impact on the liability of third party guarantors; and

- hold meetings of the member(s) and creditors of the Company to approve the Rescue Plan.

Step 6 - If the Rescue Plan is passed by 60% of creditors in number of at least one impaired class of creditors, representing a majority in value of the claims in that class, it becomes binding on all creditors within 21 days of a notice being filed with the relevant Court (assuming no objection has been filed (see below)).

A creditor may file an objection with the relevant Court (on a number of prescribed grounds) within 21 days of the notice being filed with the Court.

Principal Differences with Examinership

- The Revenue Commissioners (and other state creditors) can object to the inclusion of certain ‘excludable liabilities’, primarily where the Company failed to pay any debt or liability relating to:

- Any tax, duty, levy or other charge of a similar nature payable to the State;

- Redundancy Payments Acts 1967 to 2014;

- Protection of Employees (Employers’ Insolvency) Acts 1984 to 2020

- Social Welfare Consolidation Act 2005.

- The Process is principally an administrative one, such that the Court will only become involved when called upon to do so, in certain prescribed circumstances. The relevant jurisdiction of the Court (be it Circuit or High Court) is determined by the PA.

- The Company is not afforded automatic protection but may apply to the relevant Court for protective orders (e.g. (i) that no proceedings may be initiated or (ii) a receiver appointed for less than 3 working days/a provisional liquidator shall cease to act).

- The Process cannot be initiated by a creditor.

- The Rescue Plan may provide for the repudiation of contracts on behalf of the Company (following engagement with the creditor) where the PA considers it necessary for the survival of the Company as a going concern. This potentially obviates the need to seek Court approval but is subject to the relevant creditor’s right to object to the Rescue Plan.

- Given the lack of Court oversight, the Act makes provision for additional safeguards/obligations, including:

- Risk of criminal offence for a director’s failure to provide any relevant information or providing false or misleading information; and

- The PA is obliged to report certain director offences to the DPP and the ODCE;

- The Process will not currently be recognised under the Recast Insolvency Regulation (Regulation (EU) 2015/848).

Commentary

While the Act provides a welcome opportunity for the SME sector to avail of a restructuring process, it remains to be seen if the regime will be allowed to operate in practice as intended. The process might contemplate the write-down of debt but the Company will have to be able to continue trading both during and immediately following the conclusion of the process. This could be undermined by the fact that:

- There is no automatic prohibition on enforcement.

- Fresh third party investment is less likely to be forthcoming for SMEs, which typically have tighter margins. In the absence of investment, the Company will be reliant on the continued co-operation of its lenders and other key creditors (making a write-down of their debt less likely in practice).

- It is particularly striking that potentially significant creditors such as the Revenue Commissioners might ‘opt-out’ from participating in the process.

The Act therefore fills an obvious gap in the Irish restructuring sector but its practical use for SMEs remains to be seen.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below