The Securitisation Regulation: Transparency and Notification Requirements

In addition to the transparency obligations set out in the Securitisation Regulation 2017/2402, originators, sponsors and securitisation special purpose entities that first issue securities of a securitisation after 1 January 2019 must ensure that they notify the Central Bank of Ireland of the securitisation. Failure to do so could result in sanctions, including significant fines.

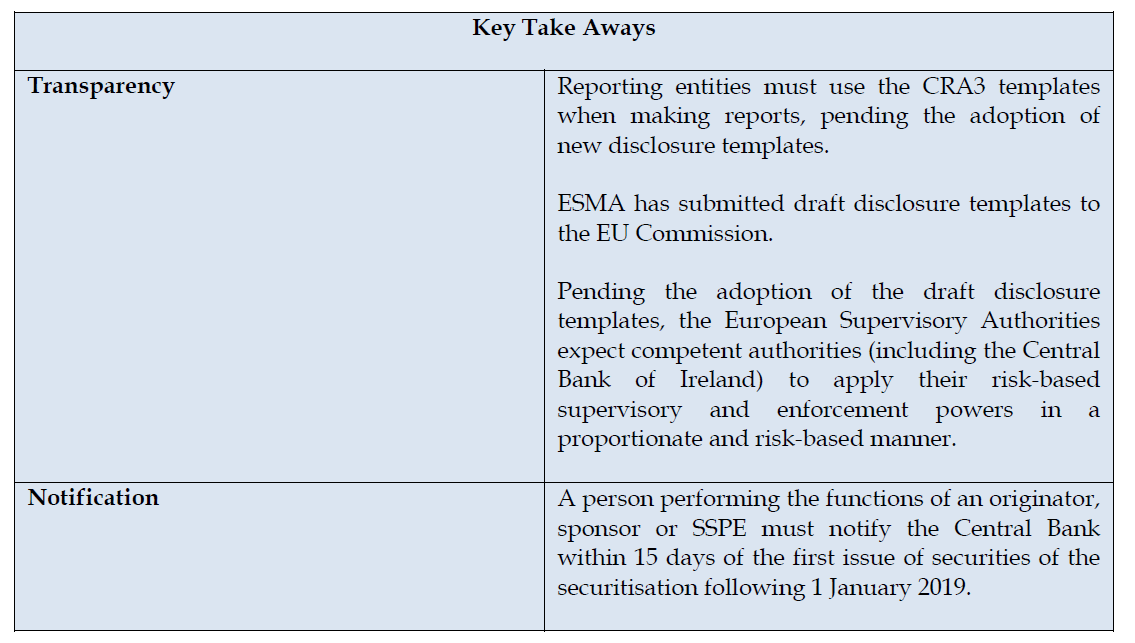

This briefing deals with recent developments relating to the transparency obligations set out in Article 7 of the Securitisation Regulation and the Irish Securitisation Regulations, including the new Central Bank of Ireland ("Central Bank") notification requirement.

The Securitisation Regulation

The Securitisation Regulation aims to revive EU securitisation as a way of diversifying funding sources, unlocking capital and promoting the integration of the EU’s capital markets. It applies to all securitisations the securities of which are issued, or securitisation positions created, after 1 January 2019 (see our related briefing here).

As a reminder, the Securitisation Regulation defines “securitisation” as a transaction where the credit risk associated with an exposure or a pool of exposures is tranched, and which has all of the following characteristics:

- payments in the transaction are dependent upon the performance of the exposure or of the pool of exposures;

- the subordination of tranches determines the distribution of losses during the ongoing life of the transaction or scheme; and

- the transaction or scheme does not create specialised lending exposures (i.e. those possessing all of the characteristics listed in Article 147(8) of Regulation (EU) No 575/2013).

Transparency Requirements

The Securitisation Regulation sets out transparency requirements, applicable to all in-scope securitisations. Specifically, Article 7 of the Securitisation Regulation provides that the originator, sponsor or SSPE must make certain prescribed information relating to the securitisation available to investors, competent authorities and, upon request, to potential investors. The originator, sponsor and SSPE are to designate one of them to fulfil this requirement.

The EU is in the process of preparing standardised disclosure templates to be used for the purpose of complying with these requirements. As these templates were not finalised by 1 January 2019, the transitional provisions set out in Article 43(8) of the Securitisation Regulation now apply, meaning that originators, sponsors and SSPEs should use the templates in Delegated Regulation 2015/3 (which were designed for the purpose of the Credit Rating Agency Regulation 1060/2009) for the purpose of making their Article 7 disclosures.

Reporting entities are experiencing operational challenges in using the CRA3 Templates, and on 30 November 2018, the European Supervisory Authorities (“ESAs”) published a joint statement (the “Joint Statement”)(here) addressing this issue, among other things.

According to the Joint Statement, the ESAs have been made aware of “severe operational challenges” for reporting entities in their having to report, on a transitional basis, using the CRA3 Templates, in particular regarding those reporting entities that have never provided the information required under the CRA3 Templates. The ESAs further note that reporting entities may have to make substantial and costly adjustments to their reporting systems in order to comply with the CRA3 Templates. In this respect, the ESAs stated that they expect competent authorities:

To generally apply their supervisory powers in their day-to-day supervision and enforcement of applicable legislation in a proportionate and risk-based manner. This approach entails that CAs can, when examining reporting entities’ compliance with the disclosure requirements of the Securitisation Regulation (which will apply from 1 January 2019, albeit in a non-standardised manner), take into account the type and extent of information already being disclosed by reporting entities. This approach does not entail general forbearance, but a case-by-case assessment by the CAs of the degree of compliance with the Securitisation Regulation.

On 31 January 2019, ESMA published an Opinion containing a revised set of draft disclosure technical standards, which are now being considered by the EU Commission (here). ESMA also published a set of Q&A based on stakeholder feedback and questions on the disclosure technical standards received by ESMA since 22 August 2018.

The Irish Securitisation Regulations

The Irish Securitisation Regulations give further effect to the Securitisation Regulation (collectively, the "Regulations") and entered into force on 1 January 2019. In particular, they set out requirements relating to the notification of a securitisation to the Central Bank. In addition, according to the Central Bank on its website (here), any entity acting as an institutional investor, originator, sponsor, original lender or SSPE should be prepared to evidence the arrangements, processes and mechanisms it has in place to ensure compliance with all relevant requirements of the Securitisation Regulation.

The Central Bank is designated as the competent authority for the purpose of the Regulations, with the exception of certain competencies that are allocated to the Pensions Authority. Both the Central Bank and the Pensions Authority must cooperate closely with each other, with the ESAs and with other competent authorities for the purpose of carrying out their respective duties.

The Irish Securitisation Regulations apply the Central Bank’s existing administrative sanctions regime – applicable to all regulated financial services providers in Ireland - to the supervision, investigation and sanctioning of breaches or suspected breaches of the Regulations by regulated financial services providers. They also provide for a similar regime to apply to entities which are not regulated financial services providers.

The sanctions which the Central Bank is empowered to impose upon finding a breach of the Regulations range from cease and desist orders, the issue of public statements (name and shame notices) to fines of up to €5 million, or twice the profits obtained through breach of the relevant provisions, or 10% of total annual net turnover. These sanctions are consistent with those set out in the Securitisation Regulation.

Notifying the Central Bank

Under the Irish Securitisation Regulations, a person performing the functions of an originator, sponsor or SSPE must notify the Central Bank in respect of the first issue of securities of the securitisation following 1 January 2019.

The notification must include the following information:

(a) the International Securities Identification Number (ISIN) of the securitisation (if any);

(b) whether the person making the notification is an originator, sponsor or SSPE with respect to the securitisation;

(c) if applicable, the name and registered address of the person required to comply with a requirement under the STS Regulation, where the STS Regulation provides discretion in respect to whom among the originator, sponsor and SSPE is to comply with such requirement;

(d) details of whether the person making the notification is a corporate or non-corporate entity and the name, registered address, corporate status and Legal Entity Identifier (if any) of -

The Central Bank expects that supervised firms will use pre-existing channels of communication with supervisors to discharge the notification requirement.

According to the Central Bank’s Guidance Notes on Special Purpose Entities (“Guidance”), an SSPE that is already subject to the Central Bank’s FVC registration regime should self-declare securitisation on the SPE (FVC) registration form, under section ‘SPE Activity Information’ when initially registering a new SPE (FVC) and submit the completed form to fvcstats@centralbank.ie. Existing SPEs (FVCs) that are already registered that issue an additional securitisation under this regime must also complete and submit the registration form.

All other entities should send the notification to securitisation@centralbank.ie.

Generally, the notification must be made not later than 15 days after the first issue of securities of the securitisation. However, according to the Guidance, in the case of SSPEs subject to the FVC registration regime, as the deadline for registering such an entity is sooner than the 15 working days after the issuance of securities, it would be preferable for the entity to complete the notification requirements by the earlier submission date (namely, 5 days after the entity first engages in financial transactions). If the entity is not in a position to complete the questions stemming from the regulation by the earlier submission date it may complete the registration form without these questions and then provide an updated registration when in a position to answer these questions, but within the legal deadline of 15 working days after the issuance of securities.

Comment

The Irish Securitisation Regulations require originators, sponsors and SSPEs to notify an in-scope securitisation to the Central Bank. However, not all EU-established originators, sponsors and SSPEs will fall within scope of the Irish Securitisation Regulations and some may be subject to domestic measures in other EU jurisdictions. This could mean that certain securitisations must be reported to competent authorities in several EU jurisdictions.

Not all securitisations entail an issue of securities. Under the Securitisation Regulation the general position is that it will apply to securitisations the securities of which are issued, or which create new securitisation positions, on or after 1 January 2019. However, under the Irish Securitisation Regulations the notification requirement arises when the securities are first issued and these Regulations do not expressly state that the notification requirement applies in a similar manner to securitisations which do not involve the issue of securities (but which do result in the creation of securisation positions). However, subject to any guidance on this point that may be issued in due course by the Central Bank, this would seem to be a prudent interpretation of the Irish Securitisation Regulations.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below