Your Next KIID Update: ESMA Q&A on Benchmark Disclosures in UCITS KIIDs

If you have not updated your UCITS’ KIID since ESMA’s publication of its revised UCITS Q&A on 29 March 2019 (the “Q&A”), remember that these revisions may need to be reflected in your next update. The revisions provide further guidance on:

- the disclosure of the benchmark index in the Objectives and Investment Policy section of the KIID; and

- the disclosure of information regarding the past performance of the benchmark index.

Objectives and Investment Policy

According to Article 7(1)(d) of Commission Regulation 583/2010, (the “KIID Regulation”), the description contained in the KIID’s “Objectives and Investment Policy” section must cover a UCITS’ essential features, including: a) whether the UCITS allows for discretionary choices in regard to the particular investments that are to be made (eg, whether it is actively or passively managed), and b) whether this approach includes or implies a reference to a benchmark and if so, which one. The Q&A give further guidance on these requirements.

Whether the UCITS allows for discretionary choices

- Index tracking UCITS - ESMA recommends using the terms “passive” or “passively managed”, in addition to “index tracking” and a UCITS Management Company (“UCITS ManCo”) should consider providing additional wording to ensure the meaning of these terms is clear. An index tracking UCITS must also disclose the index it is tracking and show performance against that index in the past performance section of the KIID;

- UCITS that allows for Discretionary Choices – ESMA recommends using the terms “active” or “actively managed” and a UCITS ManCo should consider providing additional wording to ensure that the meaning of these terms is clear. The KIID must also indicate whether or not the UCITS is managed in reference to a benchmark index and, if so, provide additional disclosure of the use of the benchmark index. It should be clear which benchmark index (or indices) the UCITS is tracking, or in reference to which it is being managed.

Including/implying a reference to a benchmark

It is the UCITS ManCo’s responsibility to identify whether the UCITS is in practice managed in reference to a benchmark, which may be the case at the outset of a UCITS’ existence, or may be introduced during its life-cycle.

According to the Q&A, a UCITS managed in reference to a benchmark index is one where:

The Q&A set out a non-exhaustive list of examples of situations where a benchmark index plays such a role in respect of these examples.

Portfolio composition

Examples of situations where the benchmark index plays a role in the definition of the portfolio’s composition include the following:

- a UCITS uses a benchmark index as a universe from which to select securities – this applies even if only a minority of securities listed in the index are held in the portfolio and the weightings of the UCITS’ portfolio holdings diverge from their equivalent weighting in the index;

- the UCITS portfolio holdings are based upon the holdings of the benchmark index. For example,

- the individual holdings of the UCITS’ portfolio do not deviate materially from those of the benchmark index;

- monitoring systems are in place to limit the extent to which the portfolio holdings and/or weightings diverge from the composition of the benchmark index

- the UCITS invests in units of other UCITS or AIFS in order to achieve similar performance to a benchmark index.

Performance measures

Examples of situations where a benchmark index plays a role in the definition of the UCITS’ performance objectives and measures include the following:

- performance fees are calculated on the basis of performance against a reference benchmark index;

- the UCITS has an internal or external target to outperform a benchmark index;

- contracts between the UCITS ManCo and third parties or between the ManCo and its directors and employees state that the portfolio manager must seek to outperform a benchmark index;

- individual portfolio managers receive an element of performance-related remuneration based on the UCITS’ performance relative to a benchmark index;

- the UCITS is constrained by internal or external risk indicators that refer to a benchmark index (eg tracking error limit, relative VaR for global exposure calculation); and

- the UCITS ManCo issues marketing to investors or potential investors which shows performance of the UCITS compared with a benchmark index.

Indicating the degree of freedom from the benchmark

Article 7(1)(d) of the KIID Regulation also provides that where a reference to a benchmark is implied in a UCITS’ approach, the description must indicate the degree of freedom available in relation to this benchmark.

According to the Q&A, to satisfy this requirement, investors should be provided with an indication of how actively managed the UCITS is, compared to its reference benchmark index. In this respect, the KIID should strike a balance between providing the level of detail required to sufficiently disclose a UCITS’ degree of freedom from a benchmark index and the obligation to do so in clear language understandable to a retail investor. The UCITS ManCo should at least take account of the following elements:

- the description of the underlying investment universe of the UCITS should indicate to what extent the target investments are part of the benchmark index or not;

- the KIID should describe the degree or level of deviation of the UCITS in regards to the benchmark index, considering, where applicable:

- the quantitative and/or qualitative deviation limitations underlying the investment approach, and

- the narrowness of the investment universe.

Unless stricter requirements apply in a given Member State, a UCITS which is actively managed in reference to a benchmark index is not required to quantify the degree of freedom numerically. However, where the UCITS ManCo believes this information will assist investor understanding, it can do so by providing explanations in language which retail investors will be able to understand. The Q&A provide illustrative (and non-exhaustive) examples of wording which could be used in such circumstances.

Where a UCITS’ defined strategy is to vary the risk it will take against an index, this should be disclosed. By way of example, a UCITS which is structured so it is managed in alignment with an index during periods of market volatility should disclose this. However, this does not mean that the UCITS’ KIID must be updated to reflect very short-term or one-off variations in the investment strategy during the lifecycle of the UCITS, provided it has already disclosed the capacity for such variations.

Past Performance Disclosure

Article 18(1) of the KIID Regulation states that where the “Objectives and Investment Policy” section of the KIID makes reference to a benchmark, a bar showing the performance of the benchmark must be included in the chart alongside each bar showing the UCITS’ past performance.

According to the Q&A, this obligation applies to all UCITS, including:

- any UCITS that references an index in its investment objectives and policy as a benchmark and measures performance against that index, even if it does not intend to track the index; and

- total return/absolute return UCITS;

- where the comparator is not named a “benchmark”, but it is clear from the objectives and investment policy that it is a comparator the UCITS aims to outperform; and

- the UCITS targets outperformance of the benchmark index over a period of time, for example “X% per annum over four years”.

The Q&A also state that the requirement for the UCITS KIID to be “fair, clear and not misleading” under Article 3(2) of the KIID Regulation means that performance disclosed in the KIID regarding a benchmark index should be consistent with performance disclosures in other investor communications, including across:

- offering documents and market material, including the prospectus;

- distribution channels;

- investor types.

Next Steps

UCITS ManCos must take steps to ensure that their UCITS KIIDs comply with the revised Q&A “as soon as practicable” or by the next KIID update following the publication of the Q&A. A number of UCITS ManCos will already have done so. Those that have not should make sure that they review the KIID in the light of the Q&A when carrying out their next KIID update, and review where necessary. UCITS ManCos should also review their marketing materials and distribution arrangements to ensure their consistency with the disclosure of past performance in the KIID.

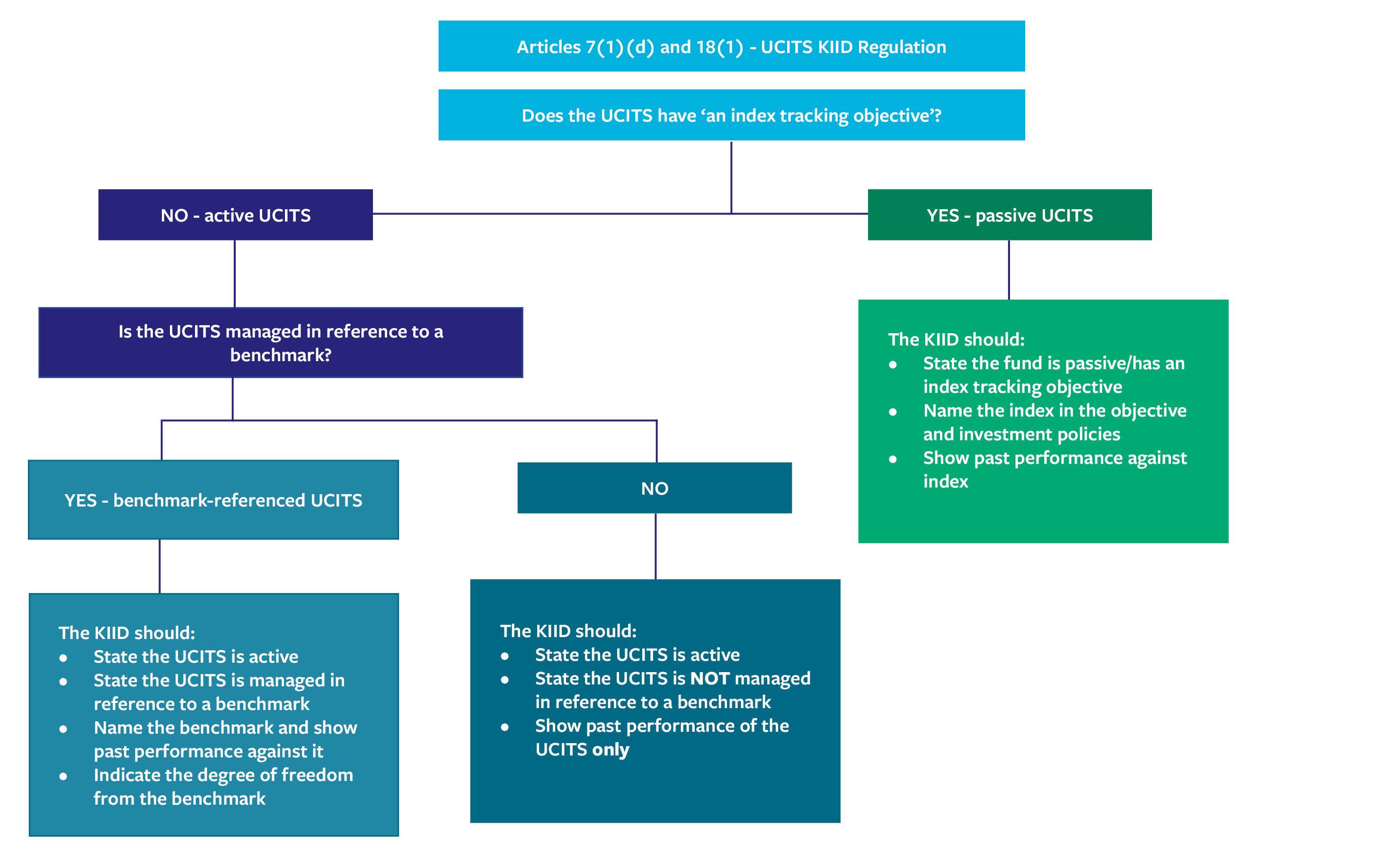

Decision Tree from ESMA Q&A

In its Q&A, ESMA provided a helpful decision tree which provides guidance on the updates to the UCITS KIID that may be required, depending on whether or not the UCITS has an “index tracking objective”. A copy of that decision tree is set out below:

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below