Additional Supervisory Levy Introduced for Asset Management Firms

The Central Bank of Ireland has announced that it will apply an Additional Supervisory Levy (“ASL”) to any asset management firm authorised on or after 1 January 2019. The ASL is in addition to the annual industry funding levy which is payable by all financial service providers regulated by the Central Bank.

In-scope firms

For the purposes of the ASL, the Central Bank defines an asset management firm as a firm authorised by the Central Bank's Asset Management: Authorisation, Advisory & Client Asset Division and supervised by the Asset Management: Supervision Division under the Investment Intermediaries Act 1995, the European Union (Markets in Financial Instruments) Regulations 2017, the European Union (Alternative Investment Fund Managers) Regulations 2013 or the European Communities (Undertakings for Collective Investment in Transferable Securities) Regulations 2011.

Details of the ASL

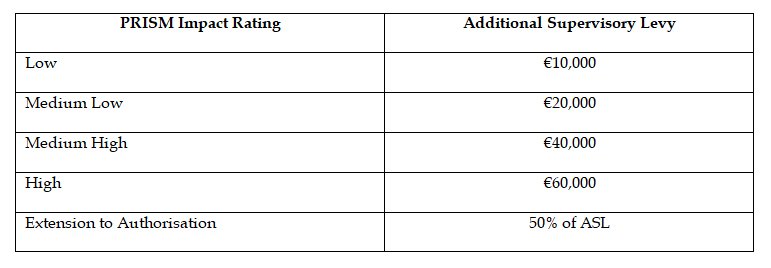

The ASL will apply, on a once-off basis, to any asset management firm authorised on or after 1 January 2019, including an authorised asset management firm seeking to extend its authorisation under the applicable legislation. An asset management firm will be liable to pay the ASL in the first year following its authorisation/approval.

The amount of the ASL payable will depend on the firm’s PRISM Impact Rating, which is issued to firms following authorisation. An asset management firm seeking to extend its authorisation will be aware already of any changes to its PRISM Impact Rating as a result of the proposed extension.

This document has been prepared by McCann FitzGerald LLP for general guidance only and should not be regarded as a substitute for professional advice. Such advice should always be taken before acting on any of the matters discussed.

Select how you would like to share using the options below